When you use a Digital Payment App, you'll be giving your friends and family easy access to your money. The apps were not meant for paying strangers, but for sharing it with your friends. You should be careful to keep sensitive information out of public view and to protect your privacy. Here are some tips to protect your money. -Avoid public transactions and friend lists. It's not easy to get your account compromised, but it's possible!

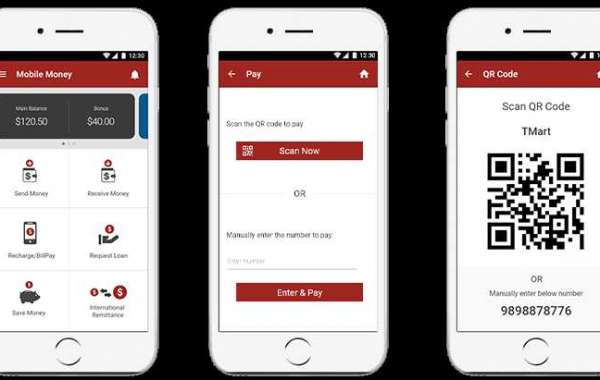

-Digital Payment App: This app helps you to pay bills easily and quickly. It uses a secure interface and stores your financial information safely. With PayPal, you'll be able to spend your money without worrying about cyber threats. This app supports more than 200 countries and nearly forty currencies. It also offers discounts and offers. Make sure to read about the terms and conditions of each platform before using it. Then, you'll be able to choose the best option for your needs.

-Digital Payment App security: Digital payment calculator App security is a major concern. While the technology is highly advanced, it's not immune to fraud. This means that you should be extra careful when using one. You can protect yourself by installing an antivirus program and setting up your accounts using trusted software. It's essential to keep your information safe from phishing websites. There are many free and paid digital payment apps available for download. In addition to the free apps, there are also free versions that allow you to transfer money from one account to another.

Another major security issue related to digital payment apps is security. It is very important to keep sensitive information out of the hands of thieves. If your password is stolen, you risk a cyberattack - which could affect your finances. You should never share your passwords with a digital payment app, as they can easily become infected with viruses. This makes it imperative that you protect yourself and your customers. There are many free digital payment apps available.

Some of the most popular ones are free to download and use, and are incredibly convenient. Some are available in both Android and iOS. Some have features that work with only one device. Other apps are more sophisticated and require a credit card. For mobile payment calculator car, you should use a digital payment app that will accept multiple types of cards and can store sensitive data. You should be able to verify the details of all transactions on the app before making a purchase.

If you're not sure which digital payment method to choose, it's best to use one that is supported by a number of currencies. This way, you can make sure that your payments are safe and secure. You should also be aware of scammers and how to avoid them. The best way to avoid them is to know how to spot them and prevent them from stealing your money. By keeping your personal information safe, you'll be able to avoid these scammers.

The best way to protect your information is to use a digital payment status app that is designed for mobile phones. Many users are more comfortable using these types of apps than with their desktop computers. For instance, if you're using an Android device, your Android phone may be less likely to be stolen if you don't have a password to protect your data. However, you should always have a backup plan in place. Even if you don't have a smartphone, you can always use a computer to make digital payments.

The best way to protect yourself against fraudsters is to use a secure digital payment app. If you're sending money to a friend, you should not share your personal information with them. In fact, if you are insecure, you can even make them lose their funds by deleting your data. Therefore, it's essential to use a secure digital payment app. It's also crucial to protect yourself from online scammers, so make sure you check out the privacy policies of the app you choose.

It's important to use a secure digital payment calculator mortgaget app. It's important to keep your information confidential. Using a secure digital payment app is not a good idea if you're not a tech savvy person. Just be sure to read reviews and learn more about the different platforms before using one. You'll never regret it! This app will be a valuable tool for your business. It will save you money in the long run.

Also Read: Digital Payment App - How to Protect Your Money

INSURITY to Come Up With Free Cloud-Based Digital Payment for Property Casuality Carrier in 2022

The Reserve Bank of India Releases a Framework for making Digital Payments Offline

Cybercriminals Likely to Target Companies and Take Advantage of Electronic Payments in 2022

Revolut Will Offer Google Pay Services For Tits Junior Customers

You will not need your debit or credit card to shop online starting January 1

Mizuho invested in MoMo, a Top Fintech App in Vietnam, Driving its Value to $2 billion