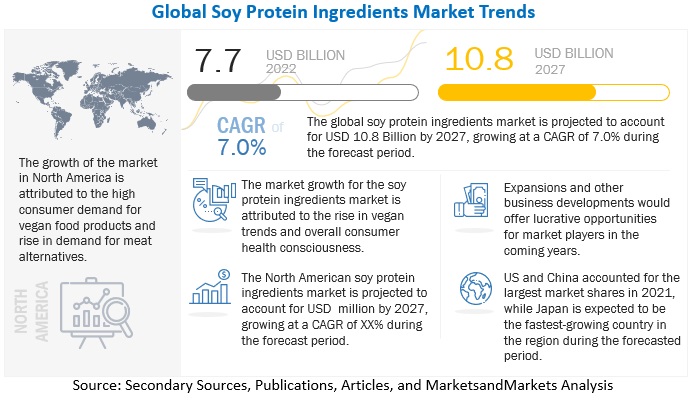

The soy protein ingredients industry was valued at USD 7.7 billion in 2022 and is projected to reach USD 10.8 billion by 2027, reflecting a compound annual growth rate (CAGR) of 7.0% during the forecast period from 2022 to 2027. Soy protein ingredients are derived from the processing of soymeal to create products with higher protein concentrations, suitable for various food and animal feed applications. The increasing demand for soy protein in both the food and animal feed sectors can be attributed to its health benefits, functional properties, and cost-effectiveness as a substitute for animal protein. This market is expected to experience significantly faster growth compared to other vegetable proteins.

Soy Protein Ingredients Market Drivers: Demand for cheaper protein source

The expansion of crop cultivation in developing regions like South America and the Asia Pacific, combined with the already extensive global cultivation, has boosted the availability of soy proteins. This makes raw materials easily accessible through contract farmers or oilseed crushers that supply soy meal. The low processing costs of soy protein align well with manufacturers' operational needs, enabling them to invest more efficiently in product development. Consequently, soy proteins are more cost-effective compared to other protein sources such as meat, dairy, and whey proteins. Moreover, with the recent rise in the prices of conventional dairy products, soy protein stands out as one of the most affordable and viable plant-based protein alternatives.

The Dry Segment by Form is Expected to Dominate During the Forecast Period.

In the industry, powdered or dry ingredients serve as exceptional texture enhancers. With the growing demand for meat alternatives and the increasing popularity of plant-based foods, companies are focusing on replicating the texture of meat in soy-based products. To achieve this, many market players have incorporated texturized soy protein ingredients into their product offerings. Since these ingredients are typically in dry form, the rising demand for texturized soy protein is also boosting the need for dry form soy protein. Additionally, their extended shelf life, convenient packaging, ease of use in recipes, and ability to blend seamlessly with other ingredients further contribute to their growing market demand.

North America is estimated to dominate the soy protein ingredients market share.

The ethical limitations and consumer awareness regarding personal and environmental health have contributed greatly to the mass shifting of people toward adopting veganism and flexitarian diets. According to a recent report published in March 2022 by the Plant-Based Foods Association (PBFA), the US plant-based food retail sales reached USD 7.4 billion, outpacing total food retail sales and showing a growth rate of 6.1% in 2021 from the previous year, despite supply chain interruptions and pandemic restrictions. This growth and increase in the demand for and consumption of plant-based foods are likely to continue during the forecast period and present significant business opportunities for soy protein ingredients.

North America is a significant production base for plant-based protein manufacturers, and the US is a key producer of soybean and wheat in the region.

Top Soy Protein Ingredients Companies:

The key players in this market include ADM (US), Wilmar International Co., Ltd. (Singapore), Cargill, Incorporated (US), CHS, Inc. (US), and Fuji Oil Holdings Inc (Japan)