Active trading demands timely and accurate information. As markets move rapidly, traders must have immediate access to data that enables them to make informed decisions. This is where a real-time stock API comes into play. In this article, we will explore how real-time stock APIs can unlock the potential of active traders, enhancing their strategies and improving their outcomes.

The Need for Real-Time Data in Active Trading

Active traders, unlike long-term investors, rely on short-term movements to generate profits. This requires them to stay ahead of the curve, often executing trades within minutes or even seconds. To achieve this, they need real-time data on stock prices, market trends, and trading volumes. Delays or inaccuracies in this data can lead to missed opportunities and losses. Real time stock API provide the solution by delivering up-to-the-second information directly to trading platforms and applications.

How Real-Time Stock APIs Work

A real-time stock API connects traders to data providers that gather and distribute market information. These APIs use sophisticated algorithms to pull data from various exchanges, ensuring that traders receive the most current and accurate information. By integrating a real-time stock API into their trading platforms, traders can access live data on stock prices, bid/ask spreads, market depth, and more. This seamless flow of information allows traders to react quickly to market changes, optimizing their trading strategies.

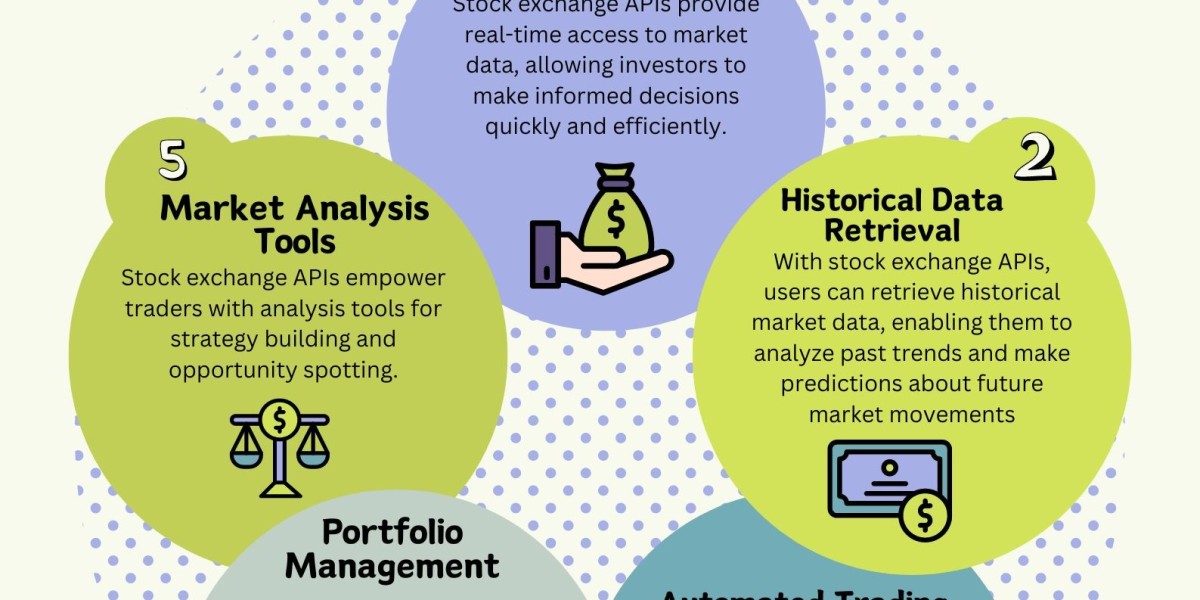

Benefits of Real-Time Stock APIs for Traders

Enhanced Decision-Making: With instant access to market data, traders can make more informed decisions. They can analyze trends as they develop, allowing them to enter and exit positions at the most advantageous times.

Automated Trading: Many active traders use automated systems to execute trades based on predefined criteria. Real-time stock APIs enable these systems to function effectively by providing the necessary data to trigger trades without delay.

Improved Risk Management: By having real-time insights into market movements, traders can better manage their risk. They can set stop-loss orders and other protective measures more accurately, minimizing potential losses.

Competitive Edge: In the fast-paced world of active trading, having a technological edge is crucial. Real-time stock APIs offer traders the advantage of speed and precision, setting them apart from those relying on delayed data.

Choosing the Right Real-Time Stock API

Not all real-time stock APIs are created equal. Traders should consider several factors when choosing the right API for their needs:

Data Coverage: Ensure the API covers the exchanges and markets relevant to your trading activities. Some APIs offer global coverage, while others may focus on specific regions.

Latency: Low latency is critical for active trading. Check the API’s response times to ensure data is delivered promptly.

Reliability: The API should have a track record of reliability with minimal downtime. Look for providers with robust infrastructure and redundant systems.

Ease of Integration: A good API should be easy to integrate with your existing trading platform or application. Comprehensive documentation and support can facilitate this process.

Cost: Consider the pricing structure of the API. Some providers offer tiered pricing based on data usage, while others may charge a flat fee. Choose a plan that fits your trading volume and budget.

Real-Life Applications of Real-Time Stock APIs

Many successful traders and financial institutions use real-time stock APIs to enhance their trading strategies. For example, high-frequency trading firms rely on these APIs to execute large volumes of trades at lightning speed. Similarly, day traders use real-time data to identify short-term trends and capitalize on them. By incorporating real-time stock APIs, these traders can improve their profitability and reduce their risk exposure.

FAQs

What is a real-time stock API?

A real-time stock API is a tool that provides up-to-the-second market data to traders and financial applications, enabling timely and informed trading decisions.

How does a real-time stock API benefit active traders?

It enhances decision-making, supports automated trading systems, improves risk management, and provides a competitive edge by delivering fast and accurate market data.

What should I consider when choosing a real-time stock API?

Consider factors such as data coverage, latency, reliability, ease of integration, and cost to ensure the API meets your trading needs.

Can real-time stock APIs be used for automated trading?

Yes, many active traders use real-time stock APIs to feed data into automated trading systems, allowing for rapid and efficient trade execution.

Are real-time stock APIs suitable for all types of traders?

While particularly beneficial for active and high-frequency traders, real-time stock APIs can also be useful for any trader who requires up-to-the-minute market data.

Conclusion

In the dynamic world of active trading, having access to real-time data is essential. Real-time stock APIs provide traders with the tools they need to make quick, informed decisions, automate their trading strategies, and manage their risk effectively. By choosing the right API and integrating it into their trading platforms, traders can unlock their full potential and achieve greater success in the markets. Embracing the power of real-time data is no longer an option but a necessity for those looking to stay competitive in today’s fast-paced trading environment.