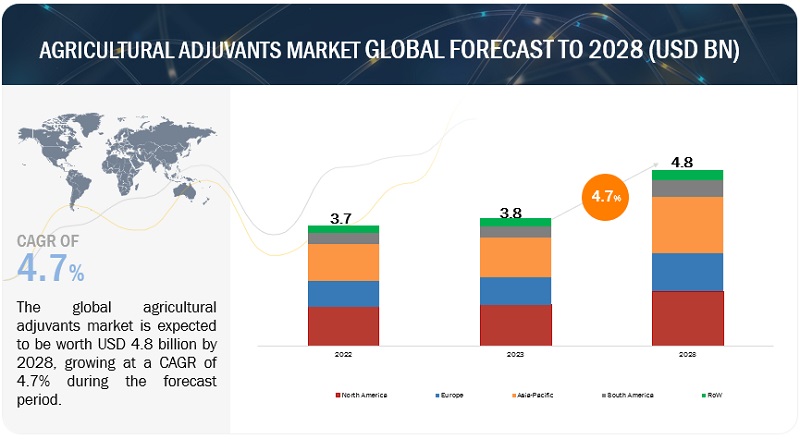

The agriculture adjuvants market size is projected to grow from USD 3.8 billion in 2023 to USD 4.8 billion by 2028 growing at a CAGR of 4.7% during the forecast period. The agricultural adjuvants industry is growing because of the growing demand for sustainable pest management of farming operations. Additionally, the increased focus on food security is projected to fuel the development of agricultural adjuvants.

Agriculture Adjuvants Market Driver: Increase in the use of natural & sustainable adjuvants

Awareness of the environmental and health risks posed by chemically derived adjuvants has been increasing. Consequently, government authorities and adjuvant manufacturers are now prioritizing renewable and sustainable products. Companies are actively addressing the demand for natural adjuvants. For example, in March 2020, Stepan Company acquired Logos Technologies LLC's NatSurFact business, which offers a line of bio-surfactants based on rhamnolipids sourced from renewable materials.

Agriculture Adjuvants Market Opportunities: Precision farming techniques to boost the application of adjuvants

Precision farming techniques, such as aerial spraying, smart irrigation, and variable rate application, are gaining popularity worldwide. Agriculture adjuvants optimize the performance of these techniques by ensuring better coverage, absorption, and penetration of agrochemicals, thereby creating opportunities for adjuvant manufacturers.

The cereals & grains crop type segment held the largest market share in the agricultural adjuvants market in 2022

Agricultural adjuvants play an essential role in agriculture’s cereal and grain segment. According to FAO, in 2022/23, global cereal production stood at 2,786.6 million tons, with wheat contributing 800.9 million tons and rice 516.9 million tons of production. With the growing production and demand for cereals & grains, the utilization of agricultural adjuvants is growing. Celeral & grains are consumed as a staple food in most countries worldwide, and protecting these crops from weather, pests, and weeds requires agricultural adjuvants. This is increasing the demand for agricultural adjuvants in cereals & grains.

North America held the largest share of the agricultural adjuvants market in 2022

The demand for agricultural adjuvants in North America is experiencing substantial growth due to several key factors. The increased cultivation of industrial crops such as corn and soybean is a major driver of this market expansion. According to reports from the United States Department of Agriculture (USDA), the US produced 13.7 billion bushels of corn and 4.28 billion bushels of soybean in 2022. Despite a decline in the production of these crops in 2021, the use of agricultural adjuvants in the region is rapidly increasing.

The key players in the agriculture adjuvants market include Corteva Agriscience (US), Evonik Industries AG (Germany), Croda International Plc (UK), Nufarm Limited (Australia), Solvay SA (Belgium), BASF SE (Germany), Huntsman International LLC. (US), Clariant AG (Switzerland), Helena Agri-Enterprises, LLC (US), and CHS Inc. (US).