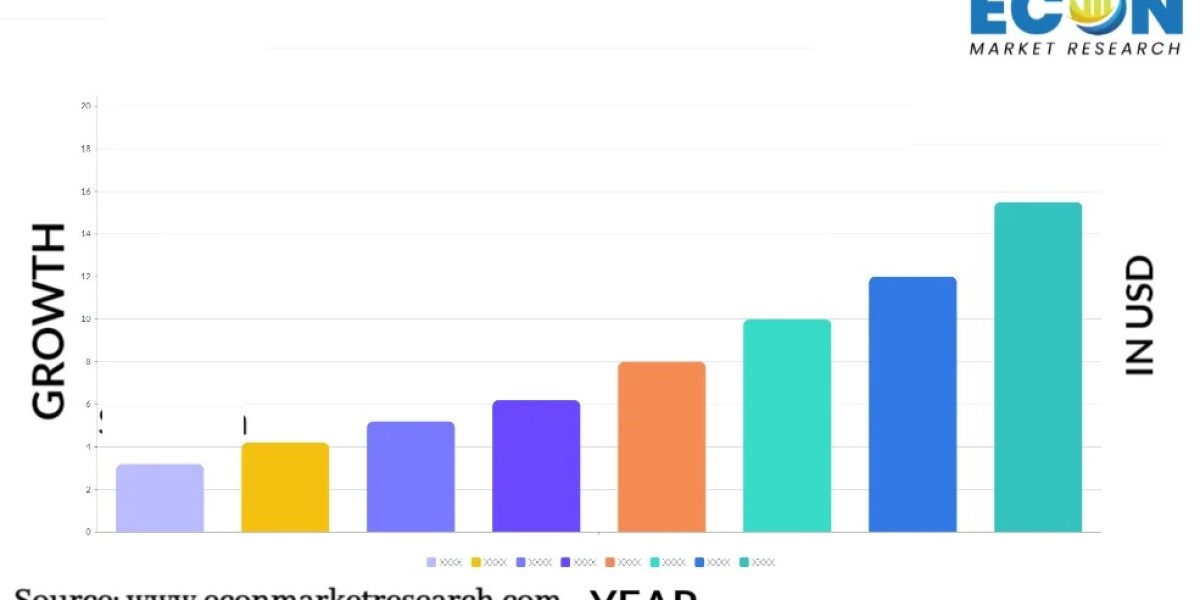

High-Performance Textile Industry is expected to reach $26,081 million by 2031 from $9,604 million in 2021, growing at a CAGR of 9.3% during the forecast period 2022-2031. The growth in the global high-performance textile market is expected to be driven by increasing demand for advanced textiles offering excellent combinations of quality, functionality, and physical properties for innovative and diversified high-tech applications to cater to various end users and consumers. However, the high cost of production and scarcity of skilled labor are some key restraining factors for the market.

Market Lifecycle Stage

The global high-performance textile market is in a growing phase. New trends, such as the 3D technology in high-performance textile, increasing demand for premium cars and adoption of safety features in the automotive industry, new product developments in protective clothing, and increasing awareness about sustainability are further expected to provide opportunities for the market to grow in the coming years.

Industrial Impact

With an increased worldwide focus on high functionality, quality, durability, and advanced specialty materials, the shift toward high-performance textiles in end-use industries is increasing, thereby creating demand for high-performance textiles. The shift is more prominent in the aerospace and defense industry in regions such as North America and Europe.

Impact of COVID-19

The COVID-19 pandemic had a huge impact on the global high-performance textile market. It altered the market in both positive as well as negative ways. During the COVID-19 pandemic, sectors that help meet necessities, such as textiles used in medical applications, showed positive growth, while demand from end-use industries, including automotive and aerospace and defense, was impacted negatively due to economic slowdown.

Market Segmentation

Segmentation 1: by End-Use Application

- Aerospace and Defense

- Automotive and Transportation

- Sports

- Energy

- Chemical

- Others

Among different high-performance textile end-use applications, aerospace and defense is expected to be the largest application during the forecast period 2022-2031.

Segmentation 2: by Fiber Type

- Aramid Fiber

- Carbon Fiber

- Glass Fiber

- High Strength Polyethylene Fiber

- Aromatic Polyester Fiber

- Others

Based on fiber type, aramid fiber accounted for 33.4% of the global high-performance textile market in 2021, as it is one of the most demanding fiber types.

Segmentation 3: by Technology

- Woven

- Non-woven

- Knitting

- 3D

Based on technology, the knitting industry accounted for a 48.7% share of the global high-performance textile market in 2021.

Segmentation 4: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, U.K., Italy, and Rest-of-Europe

- China

- Asia-Pacific and Japan - Japan, India, South Korea, and Rest-of-Asia Pacific and Japan

- Rest-of-the-World - Middle East and Africa, and South America

North America occupied the largest market share in 2021, while China is expected to lead the market by 2031.

Recent Developments in High-Performance Textile Industry

- In April 2022, DuPont announced that its renowned and recognized brands Kevlar, Nomex, and Tyvek would be developed in its plants using renewable power. This demonstrates the company's dedication to meeting its sustainability targets and embracing environmental stewardship as a core component of its 2030 sustainability initiatives.

- In March 2022, Freudenberg Performance Materials launched the latest technical textile solutions under the brand name ‘Evolon RE.’ Evolon RE is a sustainable version of its high-performance microfilament textiles and suitable for various applications, including technical packaging and high-tech wiping.

- In February 2022, Fabiosys Innovations developed an affordable and highly effective antiviral fabric using a technology called Hi-PAT. This fabric enables its antiviral function right after forming contact with the pathogens and destroys around 99.9% of them within half an hour. It is highly effective against bacteria, fungi, and viruses. The company manufactures and markets this fabric under the brand name ‘Fabium.

- In February 2021, Mitsui Chemicals announced plans to expand its production facilities for meltblown nonwovens at Sunrex Industry Co., Ltd., a wholly owned subsidiary of Mitsui Chemicals Group. Mitsui Chemicals focuses on a variety of industrial applications, along with sanitary materials and disposable diaper applications. Mitsui Chemicals Group’s overall production capacity for meltblown nonwovens is expected to increase by 30% after this expansion.

Demand – Drivers and Limitations

Following are the demand drivers for the global high-performance textile market:

- Advancement of High-Performance Textile in the Sports Industry

- Technological Advancement in the Manufacturing of High-Performance Textile

- Growing Demand for High-Performance Textile in Aerospace and Defense

Following are the challenges for the global high-performance textile market:

- Less Availability of Efficient Labor or Professionals in the High- Performance Textile Market

- High Cost of Production

Get Free Sample - https://bisresearch.com/requestsample?id=1396type=download

Key Market Players and Competition Synopsis

The companies profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some prominent names in this Industry are:

- Arville

- Asahi Kasei Corporation

- Avient Corporation

- Baltex

- DuPont

- Freudenberg Performance Materials

- Hexcel Corporation

- High Performance Textiles Pvt. Ltd.

- Huvis Corp.

- Kermel

- Kolon Industries, Inc.

- Mitsui Chemicals, Inc.

- Performance Textiles

- Porcher Industries

- Toray Industries, Inc.

- Cass Materials

- Crosslink Composites, Inc.

- Fabiosys Innovations

- High Performance Textiles GmbH

- Spintex Engineering Ltd.

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of fibers available for high-performance textile and their potential globally. Moreover, the study provides the reader with a detailed understanding of the different high-performance textile end-use applications in industries such as aerospace and defense, automotive and transportation, energy, sports, chemical, and others.

Growth/Marketing Strategy: Business expansion, partnership, collaboration, and joint venture are some key strategies adopted by key players operating in the space. For instance, in April 2022, Avient Corporation announced that the company had an agreement with Royal DSM to acquire DSM Protective Materials, including the Dyneema business. Avient has spent $1.485 billion for the acquisition to further expand its growing advanced composites portfolio.

Competitive Strategy: Key players in the global high-performance textile market analyzed and profiled in the study involve high-performance textile providers. Moreover, a detailed competitive benchmarking of the players operating in the global high-performance textile market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Analyst View

According to Pooja Tanna, Lead Analyst, BIS Research, "High-performance textiles are expected to be the best option for advanced high-tech application, where properties such as high functionality, durability, excellent cut resistance, and fire resistance are required. With the increasing focus on sustainability and technological advancement to boost the adoption in various end-use industries, the growth in the high-performance textile market is expected to be robust during the coming years.”

BIS Research Offerings - https://bisresearch.com/our-offerings/subscriptions

You May Also Like -