India Insulin Market Overview

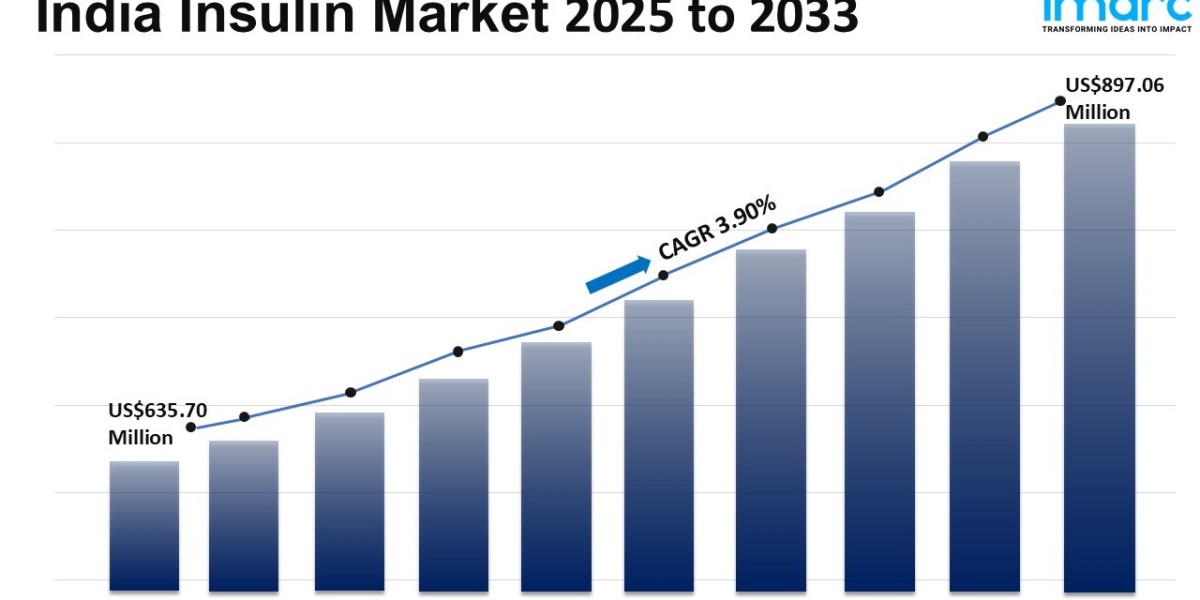

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 635.70 Million

Market Forecast in 2033: USD 897.06 Million

Market Growth Rate (2025-2033): 3.90%

The India insulin market size reached USD 635.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 897.06 Million by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033. The market is expanding due to rising diabetes cases, increasing demand for biosimilar insulin and government initiatives to improve affordability. Technological advancements in insulin delivery devices, growing domestic manufacturing and surging online pharmacies and modern retail channels are enhancing accessibility and strengthening the India insulin market share.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/india-insulin-market/requestsample

India Insulin Market Trends and Drivers:

The booming market for insulin in India is driven by a consistent increase in diabetes prevalence and higher awareness for better glycemic management. Demand for insulin therapies continues to grow with the diabetes population, and this demand has been going up along with developments in the healthcare infrastructure and government efforts to work on more affordable diabetes care. The trend towards biosimilar insulins accelerated further through commitment of funds by local pharmaceutical businesses in finding cost-effective substitutions. Moreover, as urbanization and sedentary lifestyles rise, diabetes incidences will go up, leading to ever-increasing requirements for insulin products. The innovations will be a continued boon to the market, like smart insulin pens and continuous glucose monitoring systems, ensuring patient adherence to prescribed therapies and improving their treatment outcomes.

Adoption of personalized diabetes management solutions is increasing, as they would considerably drive the India insulin market. Healthcare providers prefer customized treatment regimens to cause a prescribing increase in more modern insulin analogs presenting better efficacy and safety levels. The market is also expected to grow further because the burgeoning middle-class population having a better disposable income will spend more on premium insulin formulations. Collaboration is also getting its reward, as reputed multinational companies work with Indian manufacturers to manufacture pharmaceutical products locally, thereby reducing the dependency on imports and maintaining a stable supply in the supply chain. Moreover, telemedicine and digital health platforms will add to this as they increase the accessibility of insulin-based treatment among rural populations, where healthcare penetration has historically been limited.

The competitive environment for the India insulin market is changing with companies investing efforts into strategic price optimization, awareness campaigns, and patient education programs to gain market share. Along with the global push to universal health coverage, with subsidies for diabetic medicines, it will make insulin even more affordable for lower-income groups. Increasing investment in R&D will pave the way for the next generation of pharmaceutical insulin therapy applications such as oral and ultra-long acting, increasing convenience and compliance among patients. Non-communicable diseases will continue to win healthcare policy preference, thus making the future growth of the insulin market sustainable through innovations, accessibility, and an increasingly deep understanding of the needs of diabetes across different demographics.

India Insulin Market Industry Segmentation:

Type Insights:

- Insulin Analog

- Human Insulin

Application Insights:

- Type 1 Diabetes

- Type 2 Diabetes

Product Insights:

- Rapid-Acting Insulin

- Long-Acting Insulin

- Combination Insulin

- Biosimilar

- Others

Distribution Channel Insights:

- Hospital Pharmacies

- Retail and Specialty Pharmacies

- Others

Regional Insights:

- North India

- South India

- East India

- West India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=29603&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145