Market Overview:

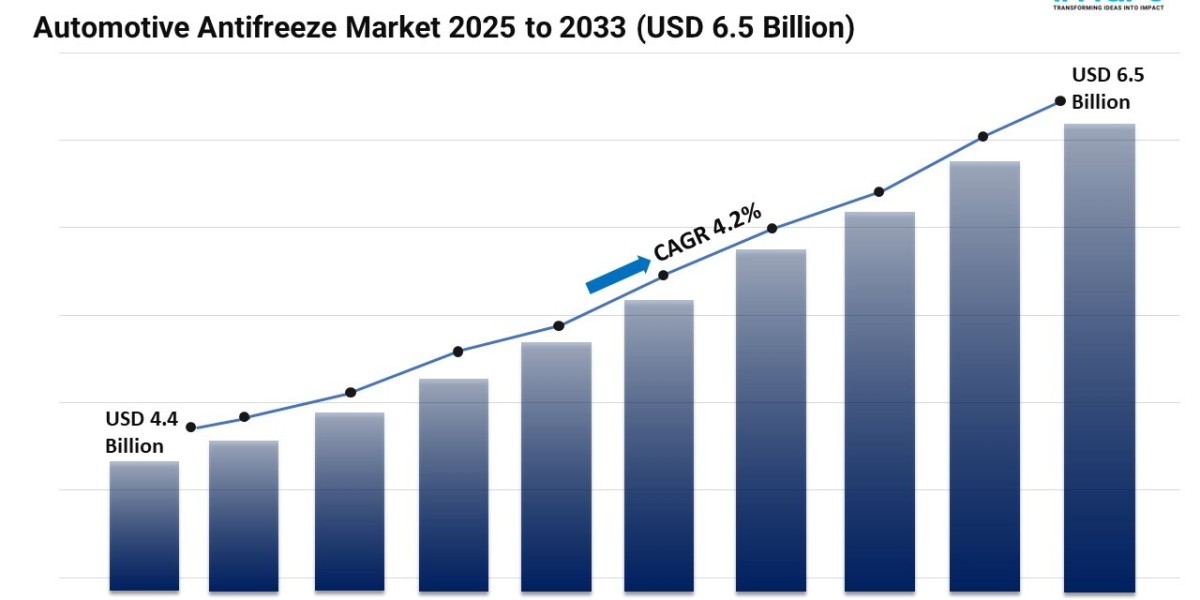

The automotive antifreeze market is experiencing rapid growth, driven by extended life & formulation advancements, environmental regulations & green chemistries, and electric vehicle cooling & thermal management. According to IMARC Group's latest research publication, "Automotive Antifreeze Market Size, Share, Trends and Forecast by Fluid Type, Technology, Vehicle Type, Distribution Channel, and Region, 2025-2033", The global automotive antifreeze market size was valued at USD 4.37 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.46 Billion by 2033, exhibiting a CAGR of 4.20% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/automotive-antifreeze-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Factors Affecting the Growth of the Automotive Antifreeze Industry:

- Extended Life & Formulation Advancements

The automotive antifreeze market is experienced by a significant change inspired by growth and progression technologies in the Eser Market coolant with extended life. This dynamic vehicle increases the service life and reduces maintenance requirements, the fuel is given to the motor vehicle industry. In addition, the introduction of organic acid technology (OAT) and hybrid organic acid technology (hoot) coolant has given rise to long -term service gaps and improved war security compared to traditional inorganic yogas. The focus on developing coolant that is compatible with a wide range of vehicle materials, including aluminum and magnesium alloys, is important for modern engine designs. The increasing demand for coolant that provides better heat transfer properties and freezer safety is to run innovation in the adorable package and the range of base fluid. The emphasis on reducing the decline of cooling fluid and preventing deposits increases the performance and life of the engine. Increasing the pre-split coolant and formulation with use to use improves the consumer's convenience and reduced the risk of incorrect mixture. The development of coolant with improved Guhikayan protection and better sealing compatibility is important for high performance engines. Increasing demand for coolant that can withstand excessive temperature variation and tough operations, operates innovation in formulation optimization. This lifetime trend is not just about long holes; It is about developing advanced yogas that increase motor protection and performance over long periods.

- Environmental Regulations & Green Chemistries

The automotive antifreeze market looks at a strong tendency to comply with strict environmental regulations and to use green chemistry motivated by the need to reduce environmental impact and promote stability. It is fuel by increasing the focus when reducing the use of dynamic harmful substances, such as ethylene glycol, and infection in more environmentally friendly alternatives. In addition, the development of the most important glycol -based coolant and biobased additives receives traction due to their low toxicity and biodegradability. Permanent production practices are to use permanent production practices by focusing on reduced environmental footprints for coolant production and disposal. Increasing demand for coolant that meets strict environmental standards, such as reach and EPA rules, operates innovation in formulation development. The emphasis on developing coolant with low aquatic poisoning and better biodegradability is important for reducing environmental pollution. Resource efficiency and waste deficiency are increased by increasing recycling systems for closed loops and coolant recovery programs. The development of coolant with low volatile organic compounds (VOC) improves air quality and activist safety. Increasing demand for transparent and tracked supply chains runs to use permanent purchasing practices and certificates. This green shift is not just about using low toxic chemicals; It is basically about replacing the antif esser industry towards more durable and environmentally responsible models.

- Electric Vehicle Cooling & Thermal Management

The automotive antifreeze market is experiencing increasing high weight on cooling and thermal control, which is driven by the growing adoption of EVs and the unique cooling requirements for their powertrain. It receives fuel from the requirement for dynamic coolant that can effectively handle the heat generated by electric motors, batteries and stream electronics. In addition, it is important for EV security and performance to develop coolant with advanced electrical insulation properties and compatibility with advanced battery chemistry. Increasing demand for coolant that can function on a wider temperature range and provide fast heat disorders, operate innovation in formulation design. Emphasis of developing coolant with low electrical conductivity and high dielectric strength is important to prevent electric shorts and ensure the reliability of the system. The growth of special coolant is increased by increasing direct cooling of battery and integrated thermal control system. The development of coolant with increased corrosion protection for uneven metals used in EV cooling systems is important for long -term durability. The increasing demand for the coolant facing high voltage and high current conditions runs innovation in adorable package and base fluid. It is important to focus on reducing the coolant decline and maintaining stable thermal properties to adapt EV performance and battery life. This EV focus is not just about cooling; It is about developing advanced thermal control solutions that ensure safety, performance and life for electric vehicles.

Leading Companies Operating in the Global Automotive Antifreeze Industry:

- AMSOIL Inc.

- BP p.l.c.

- Chevron Corporation

- Cummins Inc.

- ExxonMobil Corporation

- Fuchs Petrolub SE

- Halfords Group PLC

- Motul S.A

- Prestone Products Corporation

- Recochem Inc.

- Shell plc

- TotalEnergies SE

- Valvoline Inc.

- VOLTRONIC GmbH

Automotive Antifreeze Market Report Segmentation:

Breakup By Fluid Type:

- Ethylene Glycol

- Propylene Glycol

- Glycerine

Ethylene glycol exhibits a clear dominance in the market accredited to its effective heat transfer properties, low freezing point, and widespread availability.

Breakup By Technology:

- Inorganic Additive Technology (IAT)

- Organic Acid Technology (OAT)

- Hybrid Organic Acid Technology (HOAT)

Organic acid technology (OAT) represents the largest segment, as it offers extended life for the coolant, better corrosion protection, and compatibility with various engine components.

Breakup By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

- Construction Vehicle

Commercial vehicle holds the biggest market share attributed to the growing demand for heavy-duty vehicles in sectors like transportation and construction.

Breakup By Distribution Channel:

- Original Equipment Manufacturers (OEMs)

- Aftermarket

Aftermarket accounts for the majority of the market share due to the continuous need for coolant replacement and maintenance in existing vehicles.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific dominates the market owing to the presence of a large automotive manufacturing base and the rising vehicle ownership in the region.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145