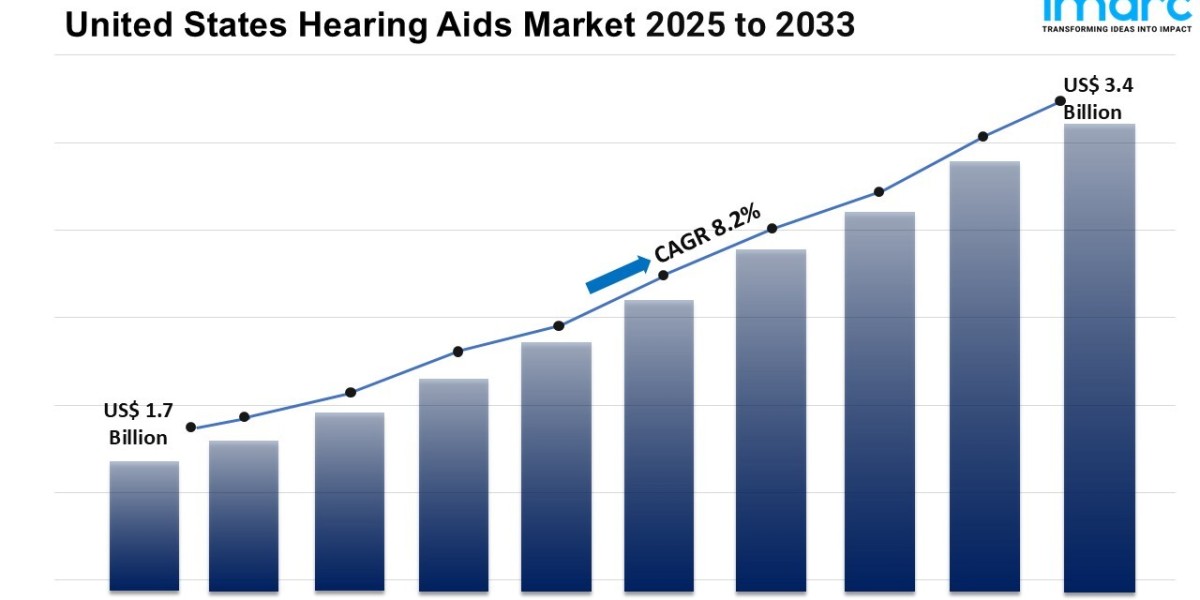

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 1.7 Billion

Market Forecast in 2033: USD 3.4 Billion

Market Growth Rate (2025-2033): 8.2%

United States hearing aids market size reached USD 1.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.4 Billion by 2033, exhibiting a growth rate (CAGR) of 8.2% during 2025-2033.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/united-states-hearing-aids-market/requestsample

United States Hearing Aids Market Industry Trends and Drivers:

The United States hearing aids market is experiencing significant expansion, driven by increasing awareness regarding hearing loss and the rising adoption of advanced audiology technologies. The growing geriatric population, which is more susceptible to hearing impairments, is a key factor fueling market growth. Additionally, continuous advancements in digital hearing aid technology, including artificial intelligence (AI) integration and Bluetooth connectivity, are enhancing user experience and driving product demand. Favorable government initiatives, including Medicare and private insurance coverage for hearing aids, are further strengthening market penetration. Moreover, the emergence of innovative hearing solutions, such as rechargeable devices and smartphone-compatible hearing aids, is reshaping consumer preferences and supporting market expansion.

The increasing prevalence of noise-induced hearing loss among younger demographics due to prolonged exposure to loud environments is accelerating the demand for hearing aids. Growing consumer preference for discreet and comfortable hearing solutions, such as invisible-in-canal (IIC) and completely-in-canal (CIC) devices, is further shaping product development. The presence of leading manufacturers investing in research and development (R&D) to enhance sound quality, battery efficiency, and customization options is boosting industry competitiveness. Additionally, the adoption of telehealth services and remote hearing aid programming is streamlining accessibility and convenience for users, especially in rural areas. The increasing availability of over-the-counter (OTC) hearing aids is also democratizing access to hearing assistance, thereby expanding the market base.

The United States hearing aids market is benefiting from a strong distribution network, including audiology clinics, pharmacies, e-commerce platforms, and direct-to-consumer sales models. The rising influence of digital marketing strategies and online consultations is enabling manufacturers to reach a wider audience and educate consumers about the benefits of modern hearing aids. Strategic collaborations between hearing aid manufacturers and healthcare providers are further reinforcing market penetration by ensuring effective diagnosis and treatment solutions. As demand for customized and AI-powered hearing aids continues to surge, companies are leveraging cutting-edge technologies to enhance speech clarity, background noise reduction, and personalized user experiences. With ongoing technological advancements and supportive healthcare policies, the market is poised for sustained growth, offering lucrative opportunities for stakeholders across the value chain.

United States Hearing Aids Market Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Product Type:

- Hearing Devices

- Behind-the-Ear (BTE)

- Receiver-in-the Ear (RITE)

- In-the-Ear (ITE)

- Canal Hearing Aids (CHA)

- Others

- Hearing Implants

- Cochlear Implants

- BAHA Implants

Breakup By Hearing Loss:

- Sensorineural Hearing Loss

- Conductive Hearing Loss

Breakup by Patient Type:

- Adults

- Pediatrics

Breakup by Technology Type:

- Analog

- Digital

Breakup by End User:

- Hospitals

- ENT Clinics and Audiology Centers

- Individual

- Others

Breakup by Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure:

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145