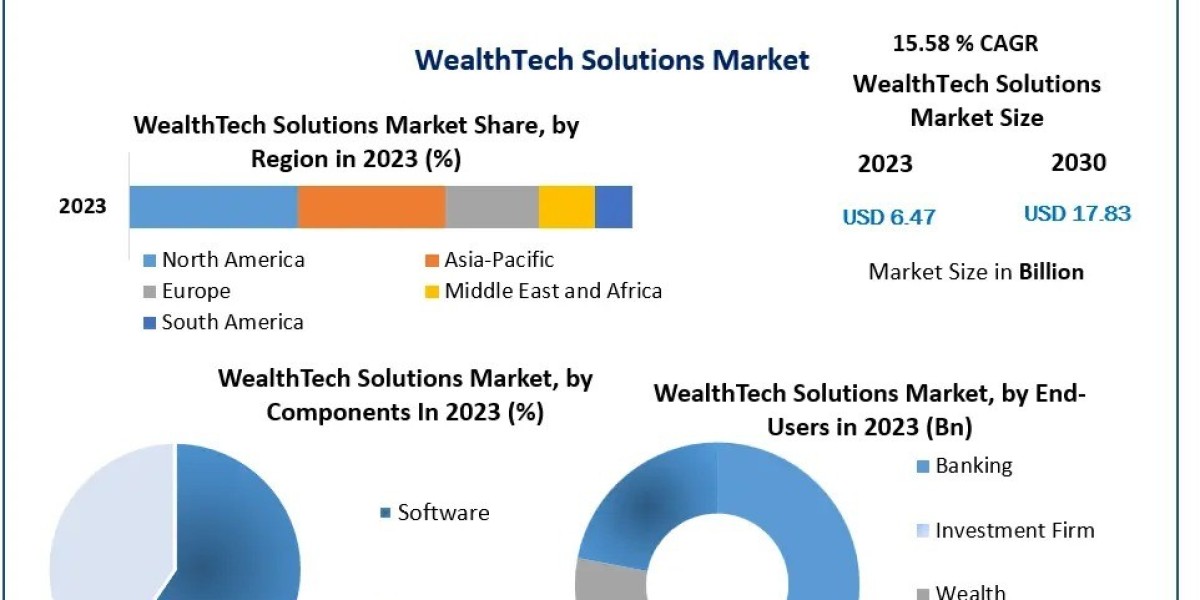

Global WealthTech Solutions Market Share Projected to Reach USD 17.83 Billion by 2030

Comprehensive Analysis Highlights Market Definition, Growth Drivers, Segmentation, Regional Insights, Competitive Landscape, and Future Outlook

Market Estimation & Definition

The global WealthTech Solutions Market, valued at USD 6.47 billion in 2023, is anticipated to reach USD 17.83 billion by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 15.58% during the forecast period from 2024 to 2030. WealthTech, a fusion of 'wealth' and 'technology,' refers to innovative digital solutions designed to enhance and streamline wealth management and investment services. These platforms offer a range of services, including portfolio management, asset liquidity optimization, cost transparency, and improved customer service, thereby transforming traditional financial advisory and investment processes.

Interested to take a sneak peek? Request a sample copy of the report to see what's inside: https://www.maximizemarketresearch.com/request-sample/167061/

Market Growth Drivers & Opportunities

The expansion of the WealthTech Solutions Market is primarily driven by evolving customer preferences and rapid advancements in digital technology. The modern, fast-paced lifestyle has led to a demand for immediate and remote financial solutions. Financial advisors and wealth management firms are increasingly adopting technology-driven tools to streamline client data management, optimize portfolios, enhance marketing effectiveness, and ensure seamless back-end operations.

Key growth drivers include:

- Digital Transformation in Financial Services: The integration of advanced analytics and digital tools is revolutionizing traditional wealth management, making services more efficient and client-centric.

- Intergenerational Wealth Transfer: A significant transfer of wealth between generations is underway, necessitating innovative solutions to manage and preserve assets effectively.

- Underfunded Retirement Savings: The growing concern over inadequate retirement funds is prompting individuals to seek advanced financial planning and investment solutions.

These factors collectively create a fertile ground for WealthTech solutions to thrive, offering opportunities for both established financial institutions and emerging fintech companies to cater to a diverse clientele.

Request your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/167061/

Segmentation Analysis

The WealthTech Solutions Market is segmented based on Component, Deployment Mode, Enterprise Size, and End User:

- By Component:

- Platform

- Services

- By Deployment Mode:

- On-Premises

- Cloud-Based

- By Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By End User:

- Banks

- Wealth Management Firms

- Investment Management Firms

- Others

This segmentation allows for a comprehensive understanding of market dynamics, enabling stakeholders to tailor their strategies effectively to meet the specific needs of each segment.

Grab your free sample copy of this report today: https://www.maximizemarketresearch.com/request-sample/167061/

Country-Level Analysis

- United States: As a leader in technological innovation and financial services, the U.S. represents a significant portion of the North American WealthTech market. The country's robust economy and high net worth individual (HNWI) population drive the adoption of advanced wealth management solutions.

- Germany: Germany stands out in Europe with a strong emphasis on digital transformation within its financial sector. The country's well-established banking system and increasing demand for efficient wealth management services contribute to the growth of the WealthTech market.

Competitive Analysis

The WealthTech Solutions Market is characterized by intense competition, with key players continually innovating to enhance their market presence. Major financial institutions and fintech companies are investing heavily in technology to offer superior services. For instance, private equity firms like Ares Management and Permira are expanding their wealth management teams to attract high-net-worth clients. Similarly, companies such as Vanguard and Robinhood are exploring wealth management services to cater to a broader audience, leveraging their large customer bases and technological expertise.

Want a comprehensive market analysis? Check out the summary of the research report: https://www.maximizemarketresearch.com/market-report/wealthtech-solutions-market/167061/

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

+91 96071 95908, +91 9607365656