Global Industrial Wireless Sensor Network Industry: Key Statistics and Insights in 2024–2032

Summary:

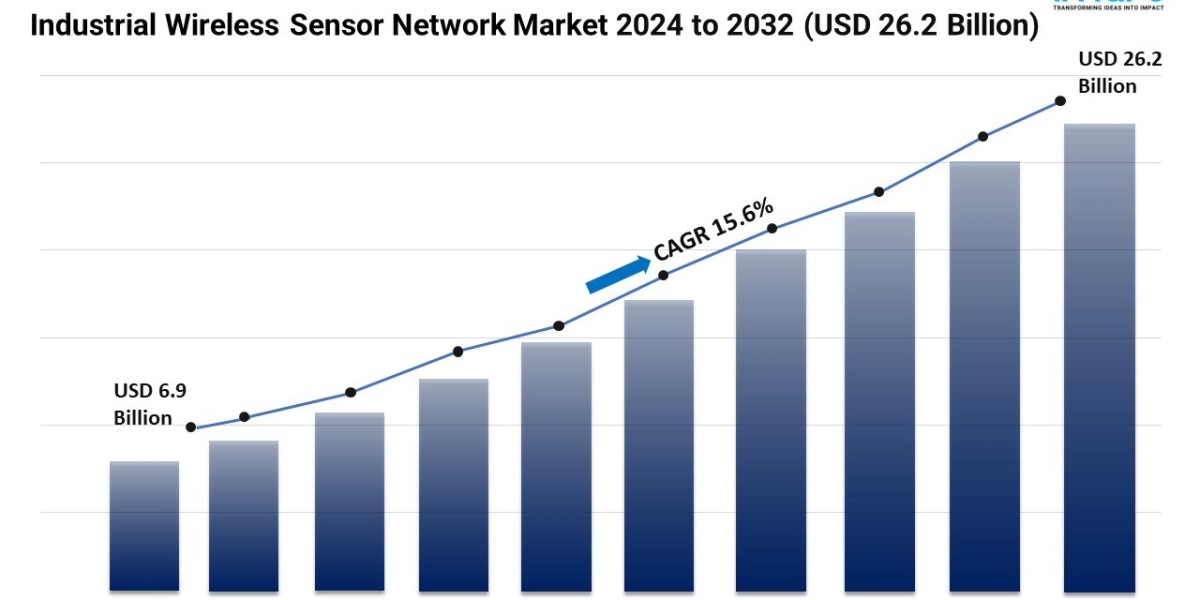

- The global industrial wireless sensor network market size reached USD 6.9 Billion in 2023.

- The market is expected to reach USD 26.2 Billion by 2032, exhibiting a growth rate (CAGR) of 15.6% during 2024–2032.

- North America leads the market, accounting for the largest industrial wireless sensor network market share.

- Software accounts for the majority of the market share in the component segment, as it provides the necessary platforms for data visualization, system integration, and predictive analytics.

- Flow sensor holds the largest share in the industrial wireless sensor network industry.

- Process monitoring remains a dominant segment in the market due to the growing need for automation and predictive maintenance.

- Based on the end use, the market has been divided into automotive, food and beverages, manufacturing, mining, oil and gas, utilities, and others.

- The rising demand for automation is a primary driver of the industrial wireless sensor network market.

- Advancements in wireless technology are reshaping the industrial wireless sensor network market.

Request for a sample copy of this report: https://www.imarcgroup.com/industrial-wireless-sensor-network-market/requestsample

Industry Trends and Drivers:

● Increasing demand for automation:

The automated industry demands permanent monitoring of manufacturing and their processes in real-time mode. This is made possible by IWSN that collects data from sensors implemented in various machines and systems. These sensors measure various factors such as temperature, pressure and humidity as well as vibrations, making it possible to have perfect control of various processes requiring automation in the absence of human intervention. Automation is all about making the best use of efforts and resources in a particular process. Incorporating IWSN in automated systems will ensure that industries reduce human intervention and hence increase the accuracy of their processes. Some sensors are connected to the control systems wirelessly and hence they can send data to the master system and coordinate the automated systems in a short time. This helps to remove congestion, speed up issues and streamline the flow of the entire process within the organization.

● Enhanced data collection and analysis:

IWSNs enable industries to collect real-time information from numerous sensors applied to machinery, gear, and operations systems. These real-time performance metrics provide near real-time information, which can help companies immediately address identified conditions. For example, manufacturing plants produce items along production lines, so production can be rapidly monitored and quickly adjusted for the betterment of the process and reduction of wastage. Collecting more data will enable industries to better track any number of processes and do so to a greater extent. IWSNs generate continuous data streams about temperature pressure, vibration and humidity and other variables to improve production operations. The collection and analysis of large amounts of data enables companies to detect problems in the business flow, reduce unavailability time, and improve processes, resulting in increased productivity.

● Advancements in wireless technology:

Advances in wireless communication standards, such as 5G, Wi-Fi 6 and LoRaWAN, are dramatically increasing data transmission speeds and bandwidth. These faster speeds and larger capacities enable IWSNs to handle greater volumes of sensor data more efficiently. This is particularly important in data-intensive industries such as manufacturing and oil and gas, where real-time monitoring and control are critical. Higher speeds allow for faster data transmission between sensors and control systems, leading to faster decision-making and more responsive operations. Recent developments in wireless technology have expanded the range of communications for IWSNs, enabling them to cover larger industrial areas.

We explore the factors propelling the industrial wireless sensor network market growth, including technological advancements, consumer behaviors, and regulatory changes.

Industrial Wireless Sensor Network Market Report Segmentation:

Breakup By Component:

- Hardware

- Software

- Service

Software represents the largest segment because it facilitates seamless integration, data processing, and analytics, which are crucial for managing and optimizing sensor networks in industrial settings.

Breakup By Sensor Type:

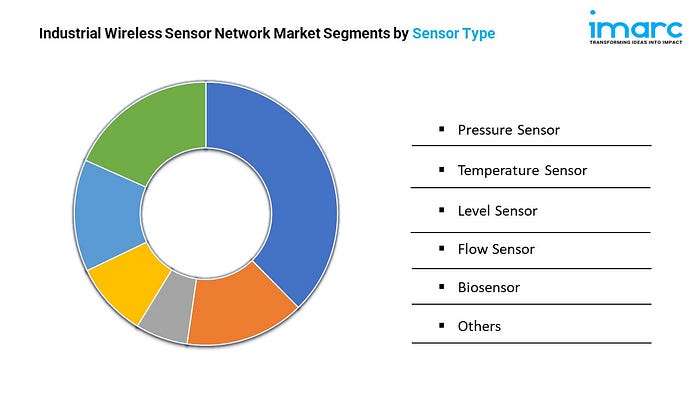

- Pressure Sensor

- Temperature Sensor

- Level Sensor

- Flow Sensor

- Biosensor

- Others

Flow sensor accounts for the majority of the market share due to its widespread use in industries like oil & gas, water management, and manufacturing, where monitoring fluid and gas flow is critical.

Breakup By Application:

- Machine Monitoring

- Process Monitoring

- Asset Tracking

- Safety and Surveillance

Process monitoring exhibits a clear dominance in the market as industries prioritize real-time tracking and optimization of production processes to improve efficiency and reduce downtime.

Breakup By End Use:

- Automotive

- Food and Beverages

- Manufacturing

- Mining

- Oil and Gas

- Utilities

- Others

Based on the end use, the market has been divided into automotive, food and beverages, manufacturing, mining, oil and gas, utilities, and others.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position in the industrial wireless sensor network market owing to the early adoption of advanced technologies, strong industrial base, and increasing investments in Internet of Things (IoT) and automation.

Top Industrial Wireless Sensor Network Market Leaders:

The industrial wireless sensor network market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- ABB Ltd

- Analog Devices Inc.

- Banner Engineering Corp.

- Emersion Electric Co.

- Endress+Hauser Management AG

- Honeywell International Inc.

- NXP Semiconductors N.V

- Schneider Electric

- Siemens AG

- ST Microelectronics

- Texas Instruments Inc.

- Yokogawa Electric Corporation

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1–631–791–1145