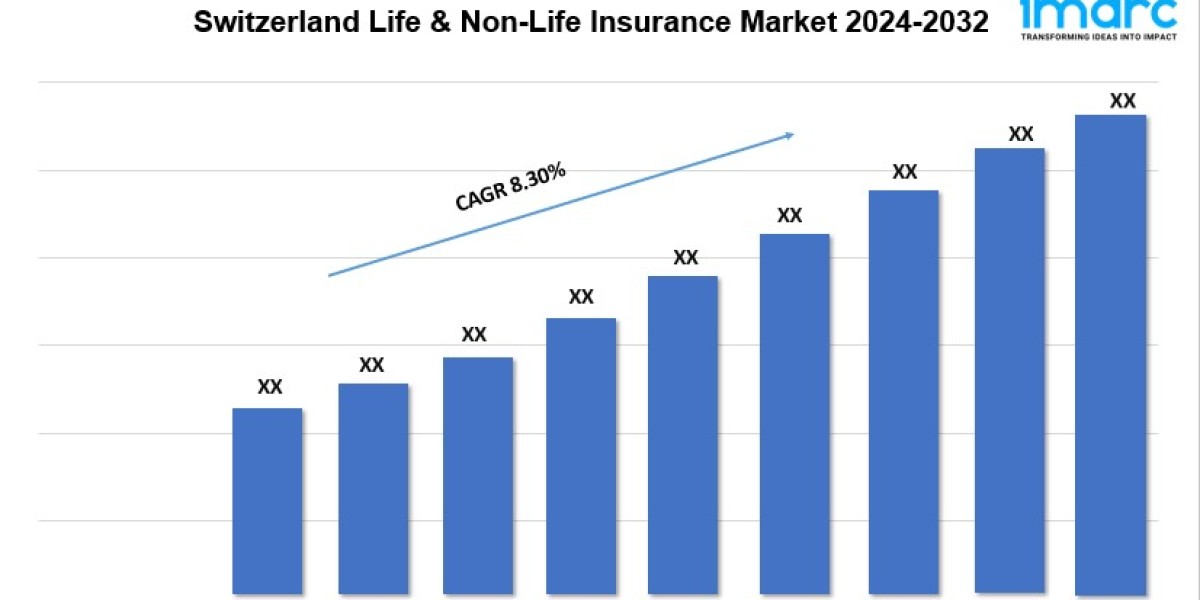

Switzerland Life & Non-Life Insurance Market Overview

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

The Market is driven by rising demand for comprehensive coverage solutions amid increasing awareness of financial risk management and evolving regulatory frameworks. According to the latest report by IMARC Group, The Switzerland life & non-life insurance market size reached USD 165.2 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 347.12 Billion by 2032, exhibiting a growth rate (CAGR) of 8.30% during 2024-2032.

Switzerland Life & Non-Life Insurance Industry Trends and Drivers:

A combination of factors, such as the robust financial infrastructure, high per capita income, as well as increasing awareness about the importance of comprehensive insurance coverage, are responsible for the growth of the Switzerland life & non-life insurance market. Additionally, in the life insurance segment, rising life expectancy and an aging population are key factors influencing market growth, as individuals seek long-term financial security and retirement planning solutions. Moreover, favorable government policies and tax benefits associated with life insurance products further encourage adoption. The non-life insurance sector is supported by growing demand for property, health, and liability insurance, driven by urbanization, technological advancements, and the increasing value of assets. The rise in climate-related risks and natural disasters has also heightened the need for property and casualty insurance, ensuring market resilience.

The integration of digital technologies and personalized services to enhance customer experience is augmenting the Switzerland life & non-life insurance market. In addition to this, insurers are leveraging artificial intelligence, and data analytics, with automation to streamline operations, optimize risk assessment, and offer tailored policy options. The adoption of insurtech solutions, such as mobile apps and online platforms, is transforming the traditional insurance landscape by making policies more accessible and manageable for customers. Furthermore, there is a high focus on sustainability and environmental responsibility, with insurers incorporating climate risk assessments and offering green insurance products. Apart from this, health-focused innovations, such as wellness programs linked to health insurance, are gaining traction, encouraging policyholders to adopt healthier lifestyles, which is anticipated to drive the Switzerland life & non-life insurance market over the forecasted period.

Download sample copy of the Report: https://www.imarcgroup.com/switzerland-life-non-life-insurance-market/requestsample

Switzerland Life & Non-Life Insurance Industry Segmentation:

The report has segmented the market into the following categories:

Insurance Type Insights:

- Life Insurance

- Individual

- Group

- Non-Life Insurance

- Home

- Motor

- Health

- Rest of Non-Life Insurance

Distribution Channel Insights:

- Direct

- Agency

- Banks

- Online

- Others

Regional Insights:

- Zurich

- Espace Mittelland

- Lake Geneva Region

- Northwestern Switzerland

- Eastern Switzerland

- Central Switzerland

- Ticino

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145