Global Ethernet Adapter Industry: Key Statistics and Insights in 2024-2032

Summary:

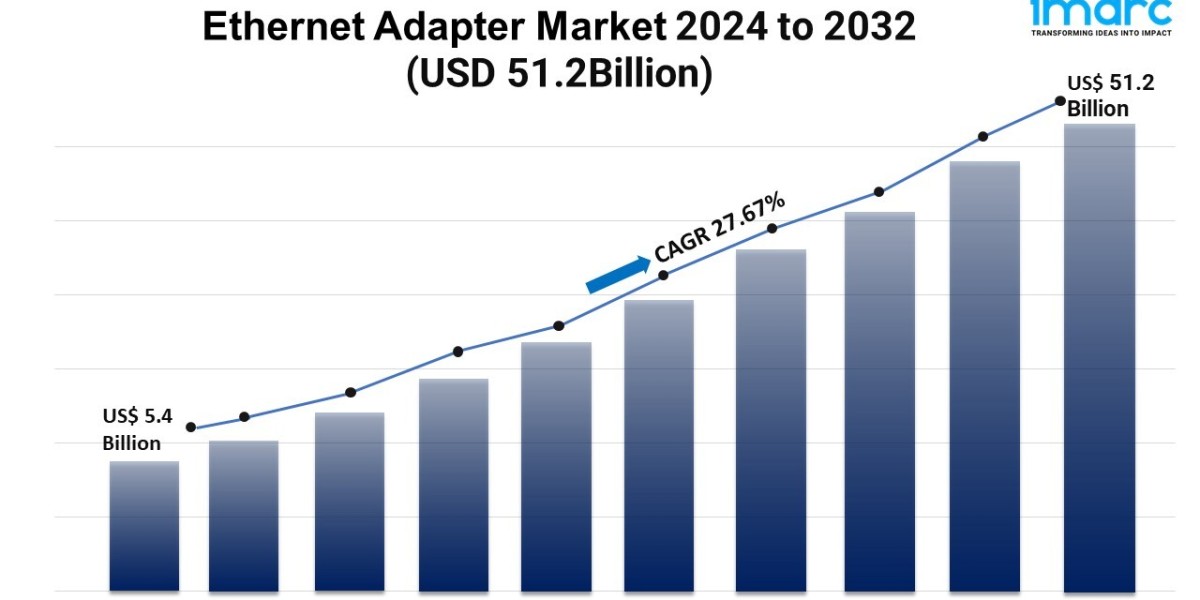

- The global ethernet adapter industry size reached USD 5.4 Billion in 2023.

- The market is expected to reach USD 51.2 Billion by 2032, exhibiting a growth rate (CAGR) of 27.67% during 2024-2032.

- North America leads the market, accounting for the largest ethernet adapter market share.

- Internal accounts for the majority of the market share in the type segment due to their simplicity, functionality, and aesthetic appeal.

- PCle holds the largest share in the ethernet adapter industry.

- Single remain a dominant segment in the market.

- Up to 1 GbE accounts for the majority of the market share.

- Embedded systems represent the leading application segment.

- Commercial represents the largest segment.

- The rise of internet of things (IoT) across various industries, such as manufacturing, healthcare, and smart cities, is a primary driver of the ethernet adapter market.

- Technological advancements in Ethernet standards, such as 25G, 40G, and 100G Ethernet, are reshaping the ethernet adapter market.

Industry Trends and Drivers:

- Increased Data Center Deployments and Cloud Adoption:

The demand for Ethernet adapters is rising due to cloud computing and more data centers. As businesses move to the cloud, they need fast, strong networks. Ethernet adapters allow quick data transfer and communication between servers and storage, vital for large data centers. Additionally, the shift to edge computing and distributed data centers is boosting the need for multi-gigabit, low-power Ethernet. This trend is driven by the demand for secure, scalable, and energy-efficient networking.

- Proliferation of Internet of Things (IoT) Devices:

The growth of IoT in sectors like manufacturing, healthcare, and smart cities is boosting the demand for Ethernet adapters. These devices need stable, real-time connections. Ethernet meets these needs with its reliability, scalability, and low latency. The rise of industrial IoT in factory automation, remote monitoring, and supply chain management is also increasing the need for Ethernet adapters. These adapters are crucial for managing large networks of devices. As IoT networks expand, the focus on secure, fast data transfer grows. Here, Ethernet adapters play a key role in ensuring network reliability and cybersecurity.

- Advancements in Ethernet Technology and Standardization:

Advances in Ethernet standards, like 25G, 40G, and 100G, are boosting the use of Ethernet adapters across various sectors. These technologies offer more bandwidth, consume less power, and improve performance. They meet the needs of high-performance computing, video streaming, and enterprise networking. Adapters with features like remote direct memory access (RDMA), virtualization, and network segmentation are now vital for businesses needing quick data transfer and low network congestion. Moreover, the push towards 400G Ethernet and beyond is set to spark more innovation, offering a scalable solution for businesses. As industries adopt faster networking technologies, the demand for compatible Ethernet adapters is on the rise.

Request for a sample copy of this report: https://www.imarcgroup.com/ethernet-adapter-market/requestsample

Ethernet Adapter Market Report Segmentation:

Breakup By Type:

- External

- Internal

Internal represents the largest segment due to its seamless integration with system hardware, offering higher performance and reliability compared to external options.

Breakup By Interface Type:

- PCIe

- OCP

- USB

PCle holds the biggest market share owing to its low latency and superior bandwidth, making it the most widely used interface in Ethernet adapters.

Breakup By Port Configuration:

- Single

- Dual

- Quad

Single represents the leading segment as it meets the basic connectivity needs of most users and applications without the added cost or complexity of multi-port configurations.

Breakup By Data Rate Per Port:

- Up To 1 GbE

- 10 GbE

- 25 GbE

- 40 GbE

- 50 GbE

- 100 GbE

- 200 GbE

Up to 1 GbE accounts for the majority of the market share. It is popular for its affordability and sufficiency for the majority of general networking tasks.

Breakup By Application:

- Servers

- Embedded Systems

- Consumer Applications

- Routers and Switches

- Desktop Systems

- Others

Embedded systems exhibit a clear dominance in the market because Ethernet adapters are essential for integrating network connectivity in a wide range of industrial and consumer electronics.

Breakup By End Use:

- Residential

- Industrial

- Commercial

Commercial represents the largest segment driven by the increasing number of businesses requiring high-performance networking solutions to support extensive information technology (IT) infrastructure and data-driven operations.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America's dominance in the ethernet adapter market is attributed to its advanced technological infrastructure, high cloud adoption rates, and strong presence of key market players.

Top Ethernet Adapter Market Leaders:

The ethernet adapter market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Anker Technology (UK) Ltd.

- Apple Inc.

- Belkin International Inc. (FIT Hon Teng Limited

- Hon Hai Precision Industry Co. Ltd.)

- Broadcom Inc.

- Digital Data Communications GmbH

- Intel Corporation

- Lenovo Group Limited

- Marvell Technology Inc.

- Nvidia Corporation

- Plugable Technologies.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163