Global 1,4 Butanediol Market Statistics: USD 12.7 Billion Value by 2032

Summary:

- The global 1,4 butanediol market size reached USD 7.7 Billion in 2023.

- The market is expected to reach USD 12.7 Billion by 2032, exhibiting a growth rate (CAGR) of 5.57% during 2024-2032.

- Asia Pacific leads the market, accounting for the largest 1,4 butanediol market share.

- On the basis of the type, the market has been bifurcated into synthetic and bio-based.

- Tetrahydrofuran (THF) holds the largest share in the 1,4 butanediol industry.

- Textile remain a dominant segment in the market, as this industry relies on BDO to meet the growing garment production needs.

- The rising demand for polybutylene terephthalate (PBT) is a primary driver of the 1,4 butanediol market.

- The growing production of spandex fiber is reshaping the 1,4 butanediol market.

Industry Trends and Drivers:

- Increasing demand for polybutylene terephthalate (PBT):

PBT is a strong, durable polymer used widely for its chemical resistance. 1,4-butanediol (BDO) is key in making PBT. As PBT demand grows, so does the need for BDO. The car industry is a major PBT user. It makes heat and stress-resistant parts like connectors, sensors, and housings. The shift towards lightweight materials in cars, aimed at boosting fuel efficiency and cutting emissions, is increasing PBT demand. This, in turn, raises the need for BDO.

- Growth in spandex fiber production:

Tetrahydrofuran (THF) is made from 1,4-butanediol (BDO). Then, THF becomes polytetramethylene ether glycol (PTMEG). PTMEG is key for spandex fibers. It's valued for its flexibility, strength, and elasticity. As spandex demand grows, so does the need for BDO. This fuels the BDO market. The rise in health and fitness trends boosts spandex demand. Also, the popularity of athleisure clothing plays a role. Spandex fibers are favored in sportswear, yoga pants, and leggings. Their comfort and elasticity make them ideal. This surge in activewear boosts spandex demand. Consequently, the need for BDO increases in the production chain.

- Expansion of the pharmaceutical sector:

1,4-butanediol (BDO) is vital in pharmaceuticals. It's a solvent and helps make key drugs. BDO is crucial for creating active pharmaceutical ingredients (APIs). The growing pharmaceutical market boosts BDO demand. It's needed to produce gamma-butyrolactone (GBL), another important compound. GBL, used in many drug-making processes, is vital for making antibiotics and tranquilizers. As the need for these drugs rises, so does the demand for BDO.

Request for a sample copy of this report: https://www.imarcgroup.com/1-4-butanediol-market/requestsample

1,4 Butanediol Market Report Segmentation:

Breakup By Type:

- Synthetic

- Bio-based

On the basis of the type, the market has been bifurcated into synthetic and bio-based.

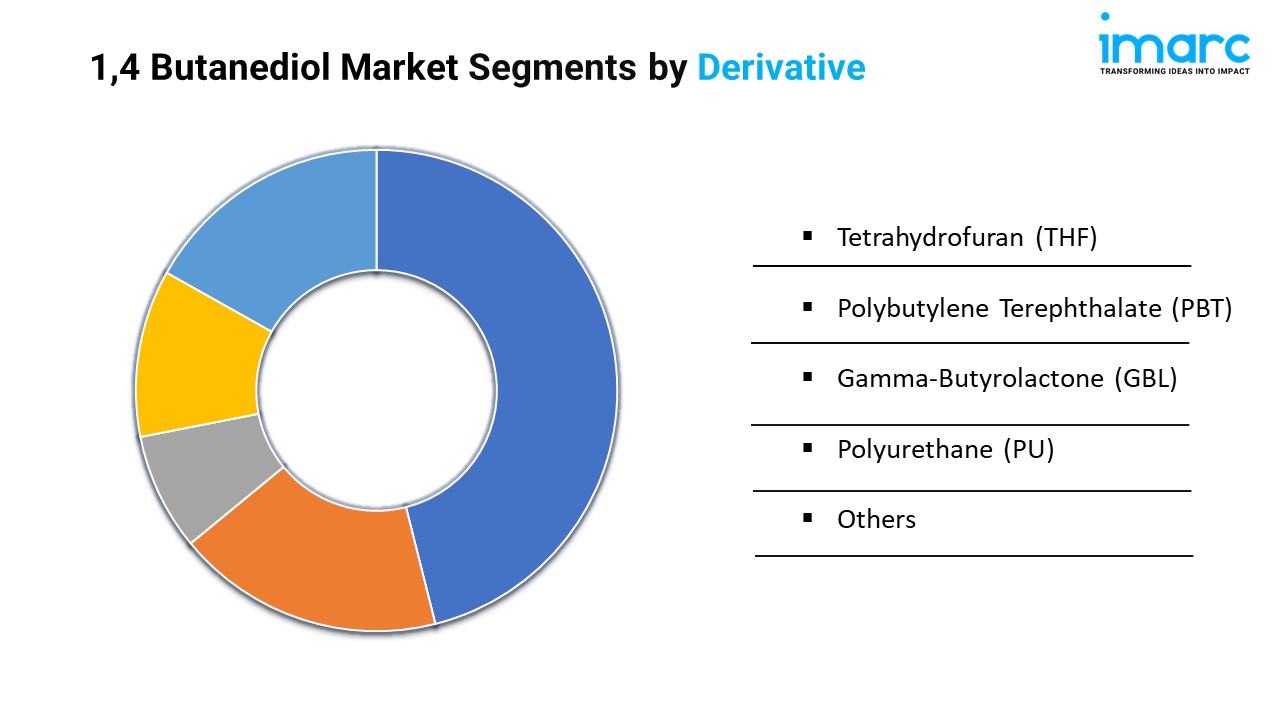

Breakup By Derivative:

- Tetrahydrofuran (THF)

- Polybutylene Terephthalate (PBT)

- Gamma-Butyrolactone (GBL)

- Polyurethane (PU)

- Others

Tetrahydrofuran (THF) represents the largest segment because THF is a key intermediate used in the production of polytetramethylene ether glycol (PTMEG), which is essential for spandex fibers and other elastomers, driving its demand in various industries.

Breakup By End Use Industry:

- Textile

- Automotive

- Healthcare and Pharmaceutical

- Electrical and Electronics

- Others

Textile accounts for the majority of the market share as spandex fibers, which are widely used in the textile industry, rely heavily on 1,4-butanediol for the production of PTMEG, a crucial component in their manufacturing.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific enjoys the leading position in the 1,4-butanediol market due to the region’s robust textile, automotive, and chemical industries, along with the presence of major BDO producers in countries like China and India.

Top 1,4 Butanediol Market Leaders:

The 1,4 butanediol market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Ashland Inc.

- BASF SE

- China Petroleum & Chemical Corporation (China Petrochemical Corporation)

- Dairen Chemical Corporation

- Genomatica Inc

- KH Chemicals BV (Ravago S.A.)

- Lanxess AG

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Corporation

- Nan Ya Plastics Corporation

- Shanxi Sanwei Group Co. Ltd.

- Sipchem Company and Xinjiang Blue Ridge Tunhe Sci.&Tech. Co. Ltd.

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145