Global Pharmaceutical Analytical Testing Outsourcing Industry: Key Statistics and Insights in 2024-2032

Summary:

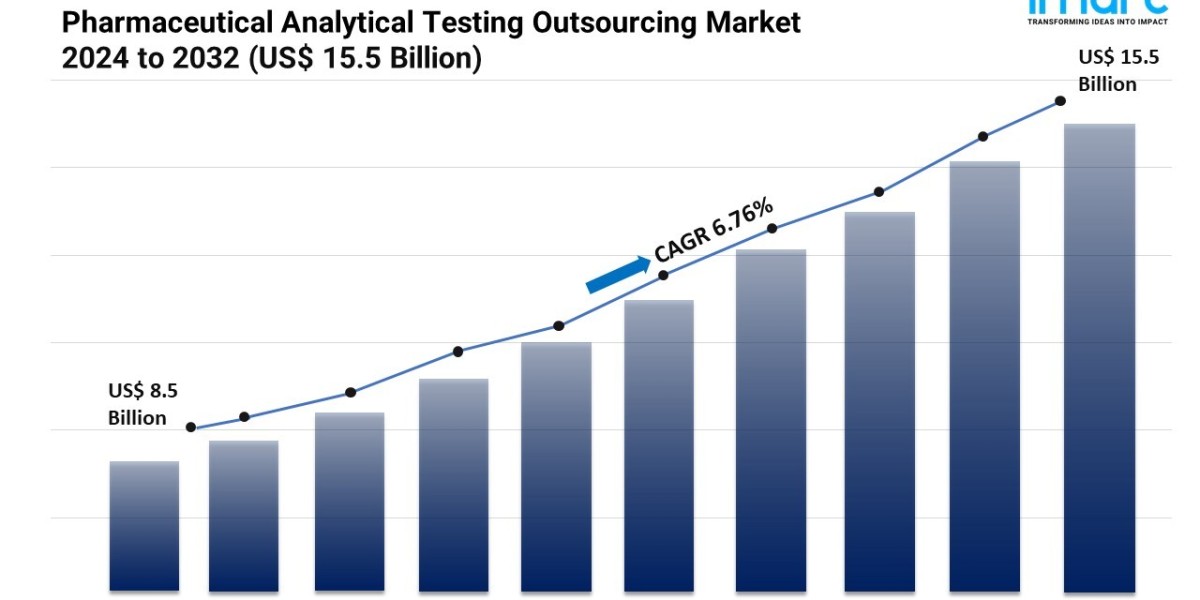

- The global pharmaceutical analytical testing outsourcing market size reached USD 8.5 Billion in 2023.

- The market is expected to reach USD 15.5 Billion by 2032, exhibiting a growth rate (CAGR) of 6.76% during 2024-2032.

- North America leads the market, accounting for the largest pharmaceutical analytical testing outsourcing market share.

- Based on the type, the market has been divided into active pharmaceutical ingredients (API), additives, and finished products.

- On the basis of service, the market has been classified into bioanalytical testing (clinical and non-clinical), method development and validation (extractable and leachable, impurity method, technical consulting, and others), stability testing (drug substance, stability indicating method validation, accelerated stability testing, photostability testing, and others), and others.

- Pharmaceutical companies remain a dominant segment in the market owing to their extensive need for analytical testing services to ensure regulatory compliance throughout the entire drug development and manufacturing process.

- The increasing investment in research and development (R&D) activities is a primary driver of the pharmaceutical analytical testing outsourcing market.

- Strict regulatory standards and controls are reshaping the pharmaceutical analytical testing outsourcing market.

Industry Trends and Drivers:

- Increasing research and development (R&D) expenditures:

The pharmaceutical industry is increasing its research and development (R&D) expenditures to foster innovation and bring new medicines to the market. This rise in R&D activities is creating a high demand for analytical testing services to ensure the quality, efficacy, and safety of new drug formulations. Outsourcing these testing services allows pharmaceutical companies to access specialized expertise and advanced technologies without investing heavily in in-house facilities. Companies can streamline their testing processes, reduce time to market, and manage costs more effectively by partnering with external laboratories. This is encouraging market growth, as firms seek to leverage external expertise for efficient drug development.

- Stringent regulatory requirements:

The pharmaceutical industry faces strict regulatory requirements to ensure drug safety and compliance. Regulatory bodies such as the Food and Drug Administration (FDA), the European Medicines Agency (EMA) and others impose rigorous standards for drug testing and quality assurance. To meet these stringent requirements, pharmaceutical companies are turning to outsourcing partners who specialize in analytical testing and compliance. Outsourcing provides access to experienced professionals and state-of-the-art facilities that are able to conduct complex testing procedures and produce accurate, regulatory-compliant results. This growing trend of regulatory scrutiny is driving the demand for outsourced analytical testing services, as companies aim to navigate the changing regulatory landscape and ensure that their products meet global standards.

- Cost efficiency and resource optimization:

Pharmaceutical companies are outsourcing analytical testing to achieve cost efficiencies and optimize resource allocation. Establishing and maintaining in-house analytical testing laboratories involves significant capital investment and ongoing operational costs. By outsourcing these services, companies can reduce overhead expenditures and redirect resources toward core activities, such as drug development and marketing. Outsourcing partners offer scalable solutions and specialized expertise that help companies manage testing requirements more flexibly and cost-effectively. This focus on cost reduction and resource optimization is one of the major factors contributing to market growth, as firms are seeking to streamline operations and enhance financial performance.

Request for a sample copy of this report: https://www.imarcgroup.com/pharmaceutical-analytical-testing-outsourcing-market/requestsample

Pharmaceutical Analytical Testing Outsourcing Market Report Segmentation:

Breakup By Type:

- Active Pharmaceutical Ingredients (API)

- Additives

- Finished Products

On the basis of the type, the market has been classified into active pharmaceutical ingredients (API), additives, and finished products.

Breakup By Service:

- Bioanalytical Testing

- Clinical

- Non-Clinical

- Method Development and Validation

- Extractable and Leachable

- Impurity Method

- Technical Consulting

- Others

- Stability Testing

- Drug Substance

- Stability Indicating Method Validation

- Accelerated Stability Testing

- Photostability Testing

- Others

- Others

Based on the service, the market is divided into bioanalytical testing (clinical and non-clinical), method development and validation (extractable and leachable, impurity method, technical consulting, and others), stability testing (drug substance, stability indicating method validation, accelerated stability testing, photostability testing, and others), and others.

Breakup By End User:

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Contract Research Organizations

Pharmaceutical companies exhibit a clear dominance in the market because they are the primary users of analytical testing services to ensure the quality, safety, and efficacy of their drug products.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position in the pharmaceutical analytical testing outsourcing market due to its thriving pharmaceutical industry, advanced technological infrastructure, and high regulatory standards.

Top Pharmaceutical Analytical Testing Outsourcing Market Leaders:

The pharmaceutical analytical testing outsourcing market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Ajinomoto Bio-Pharma Services (Ajinomoto Co. Inc.)

- Alcami Corporation Inc.

- Boston Analytical Inc.

- Catalent Inc.

- Charles River Laboratories International Inc.

- Eurofins Scientific SE

- Intertek Group plc

- Laboratory Corporation of America Holdings

- Pace Analytical Services LLC

- SGS S.A.

- Thermo Fisher Scientific Inc.

- West Pharmaceutical Services Inc.

- WuXi AppTec Inc

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145