A Quick Overview of Malaysia Online Insurance Market

The key object of this report on the Malaysia Online Insurance Market is to offer worthy data and a geographical perspective for predictions of market growth in the future. The recommendations added in this detailed report are insightful, and actionable offering a deep understanding of the industry. Moreover, it includes a comprehensive importance of aspects that have impacted the industry.

MarkNtel Advisors has recently studied an extensive market intelligence evaluation on the Malaysia Online Insurance Market. Also, the newly released report exhibits an engaging format that comprises compelling graphs, tables, charts, and figures as well. These seamlessly combined visual aids are designed to support the clarity and accuracy of the details presented, offering analysts a deep knowledge of the topic at hand.

✅In case you missed it, we are currently revising our reports. Click on the below to get the latest research data with forecast for years 2025 to 2030, including market size, industry trends, and competitive analysis. It wouldn’t take long for the team to deliver the most recent version of the report.

If you’re interested in the assumptions considered in this study, you can download the PDF brochure- - https://www.marknteladvisors.com/query/request-sample/malaysia-online-insurance-market.html

Malaysia Online Insurance Market Scenario:

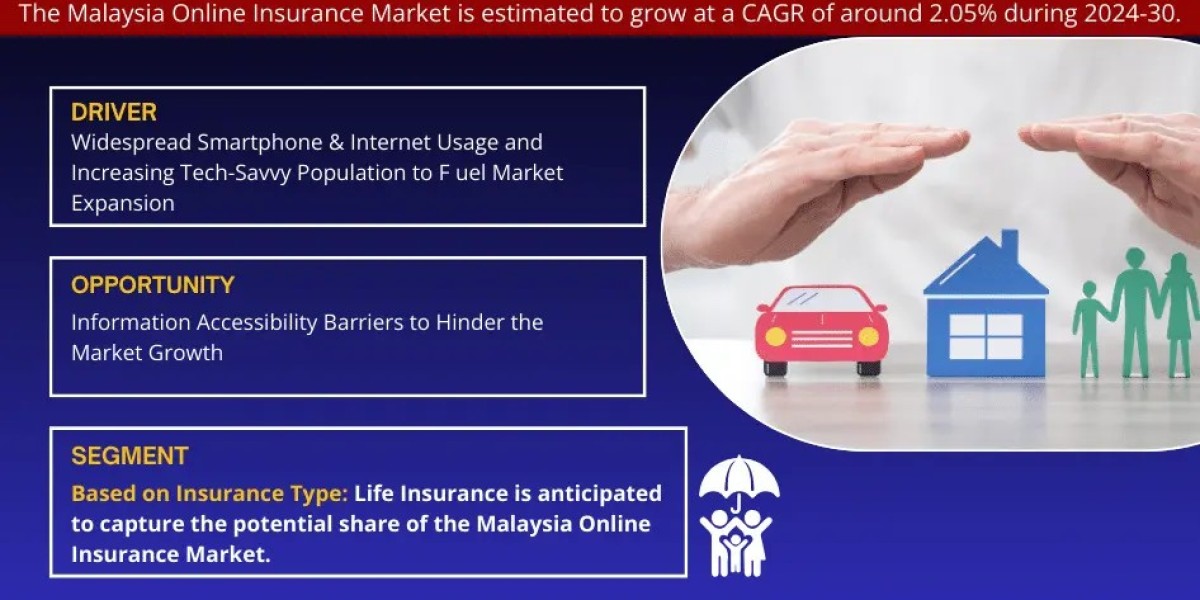

The Malaysia Online Insurance Market is estimated to grow at a CAGR of around 2.05% during the forecast period, i.e., 2024-30. The market in Malaysia has experienced significant growth, driven by factors such as widespread smartphone & internet usage, a tech-savvy population, the availability of affordable insurance options, and the convenience of online purchasing. Malaysia, with its young and digitally inclined citizens, shows a preference for the ease and cost-effectiveness of acquiring insurance online, bypassing traditional methods involving insurance brokers.

Anticipated factors, including government initiatives, technological advancements, the rise of insurance aggregators, and enhanced convenience, are poised to further propel the market, covering both motor & non-motor insurance. For instance, Bank Negara Malaysia (BNM) is in the process of developing a regulatory framework for digital insurers and digital takaful operators, which was concluded in 2022.

Malaysia Online Insurance Market - Industry Dynamics, Size, And Opportunity Forecast To 2030:

Market Driver - Widespread Smartphone & Internet Usage and Increasing Tech-Savvy Population to Fuel Market Expansion

The widespread adoption of smartphones and easy access to the internet has been instrumental in shaping the Malaysia Online Insurance Market. The younger demographic, particularly Malaysians, is becoming more connected, turning online platforms into a convenient channel for insurance transactions and driving market growth. Additionally, the country's tech-savvy population, comfortable with digital tools and online transactions, has played a crucial role in the success of online insurance platforms. This inclination towards embracing technology has further heightened the demand for online insurance, contributing to the market's upward trajectory.

Malaysia Online Insurance Market Segmentation Analysis:

Malaysia Online Insurance Industry, analyzes, identifies, and highlights the main trends and drivers which are affecting each segment of the market. The market has been further divided into the following categories:

By Insurance Type

- Life Insurance- (Market Size & Forecast 2019-2030, (USD Million)

- Health insurance- (Market Size & Forecast 2019-2030, (USD Million)

- Motor Insurance- (Market Size & Forecast 2019-2030, (USD Million)

- Home Insurance- (Market Size & Forecast 2019-2030, (USD Million)

- Others (Vehicle Insurance, Property Insurance, etc.)- (Market Size & Forecast 2019-2030, (USD Million)

By End User

- Individual Consumers- (Market Size & Forecast 2019-2030, (USD Million)

- Business Entities- (Market Size & Forecast 2019-2030, (USD Million)

- Transport & Logistics Companies - (Market Size & Forecast 2019-2030, (USD Million)

- Financial Institutions- (Market Size & Forecast 2019-2030, (USD Million)

- Others (Healthcare Providers, Government Entities, etc.)- (Market Size & Forecast 2019-2030, (USD Million)

By Enterprise Size

- Large Enterprises- (Market Size & Forecast 2019-2030, (USD Million)

- SMEs- (Market Size & Forecast 2019-2030, (USD Million)

By Region

- North

- South

- East

- Central

- Sarawak

- Sabah.

Browse Full Report Along with TOC and Figures - https://www.marknteladvisors.com/research-library/malaysia-online-insurance-market.html

Who are the Key Market Players in the Malaysia Online Insurance Market?

In the fast-changing Malaysia Online Insurance Market, understanding what our competitors are doing is crucial. By carefully analyzing things, we figured out some of the dominating players in the industry. So, the top companies of the Malaysia Online Insurance market ruling the industry are:

List of Key Companies Profiled:

- Allianz Malaysia Berhad

- Prudential Assurance Malaysia Berhad

- AIA Bhd.

- Manulife Insurance Berhad

- Zurich Malaysia

- Hong Leong Assurance Berhad

- Pacific Insurance Berhad

- Sun Life Malaysia

- Takaful Malaysia

- Generali Insurance Malaysia Berhad

- Great Eastern Life Insurance (Malaysia) Berhad

- Others (Etiqua Insurance Berhad, AM Assurance, etc.).

Global Malaysia Online Insurance Recent Development:

- January 2024: Prudential Assurance Malaysia Berhad has introduced gender-specific critical illness plans, namely "PRUMan" and "PRULady." This marks the launch of the first-ever male- & female-specific insurance plan in Malaysia, aiming to cater to the distinct health and risk variations between men & women.

Note - If there are any particular details you need that are not currently included in the report, we will be happy to provide them as part of our customization services.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address

Other Report:

· https://www.marknteladvisors.com/research-library/ultra-high-performance-concrete-market.html |

Why Choose MarkNtel Advisors:

- Focused Industry Expertise

- Diverse Report Offerings

- Personalized Research Solutions

- Robust Research Methodology

- In-depth Report Coverage

- Tracking Technological Advancements

- Comprehensive Value-Chain Analysis

- Discovering Market Opportunities

- Analyzing Growth Trajectories

- Assured Quality Insights

- Dedicated After-Sales Support

- Trusted by Fortune 500 Companies

Contact Us –

Call +1 628 895 8081, +91 120 4278433

Email: sales@marknteladvisors.com