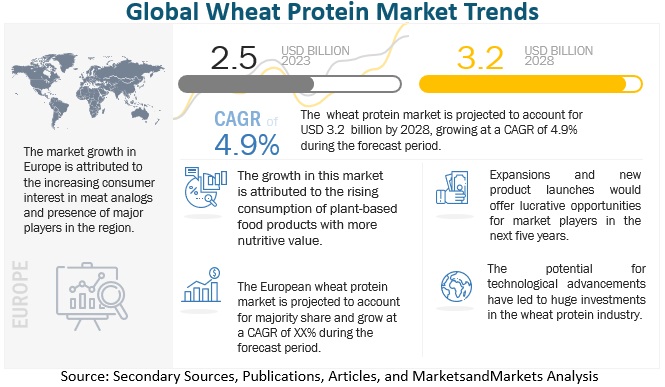

The global wheat protein market is projected to grow from $2.5 billion in 2023 to $3.2 billion by 2028, with a compound annual growth rate (CAGR) of 4.9% during this period. This growth is driven by the rising popularity of meat-free diets, increasing obesity rates leading to higher demand for low-calorie foods, and a growing consumer preference for healthier options. Wheat gluten, known for its high protein content, has seen a surge in demand, contributing significantly to the expansion of the global wheat protein market.

Wheat Protein Market Drivers: Increase in consumer preference for meat analogs

The global market for plant-based meat alternatives has seen significant growth as consumers seek products that closely replicate the fibrous structure, texture, and mouthfeel of traditional meat. This rising demand has driven the development of plant protein-based meat substitutes worldwide. Increasing awareness of healthy and nutritious eating has also given rise to a new group of consumers, known as “flexitarians,” who are looking to reduce their meat intake. This shift in dietary preferences has spurred the creation of innovative products designed to meet consumer demand for meat-like options that not only taste like meat but also offer high protein content. For example, under the European research project LikeMeat, academic researchers and small to medium-sized enterprises have successfully developed new meat alternatives. They achieved this by creating fibrous, meat-like structures from plant proteins using a modified cooking extrusion process, which were then transformed into various food products.

Wheat Protein Market Opportunities: Growing role of wheat protein in the pet industry

The global pet food market is primarily driven by two significant trends: premiumization and humanization. Pet owners increasingly view their pets as family members, leading to a heightened demand for premium pet food that offers nutritional benefits, better digestibility, and superior ingredient quality. In response to this shift, major companies like Crespel & Deiters Group (Germany) are introducing wheat protein as a key ingredient in pet food products. Wheat, commonly used in dry dog foods and biscuits, provides high-quality carbohydrates that not only supply energy for daily activities but also enhance the food's processing capabilities. As a rich source of starches, vitamins, minerals, trace elements, and fiber, wheat-based products contribute to the development of balanced and nutritious pet foods, offering a holistic approach to optimizing pet diets.

How is the adoption of plant-based meat substitutes impacting the demand for textured wheat protein?

Textured wheat protein, also known as wheat meat, wheat gluten, or seitan, is a popular plant-based protein source used as a meat substitute for many years. A study published in the journal, Foods, in 2021 found that the demand for meat substitutes, including textured wheat protein, is increasing worldwide due to health, ethical, and environmental concerns associated with meat consumption. In 2019, a survey by the International Food Information Council found that 22% of US consumers reported consuming plant-based meat substitutes, including textured wheat protein, at least once a week. Therefore, the demand for textured wheat protein is increasing globally, driven by factors such as the growing popularity of plant-based diets and the increasing demand for sustainable and ethical food products.

North America Dominates the Wheat Protein Market Share.

Countries such as the US, Canada, and Mexico have been considered in this study. The market in the US is driven by growing consumer awareness about the importance of protein in the diet, which, in turn, has encouraged the demand for functional food & beverages. The versatile functionality of wheat protein has sustained demand in the baking industry, leading to constant growth in consumption. Research and technological developments in hydrolysed wheat protein have also led to a long-term consumption trend of wheat protein in the US. However, the increase in discussion on gluten intolerance acts as a hindrance to the growth of the wheat protein market in this region. The high functional profile, low carbon footprint, and low price of wheat-sourced proteins are the key factors encouraging the consumption of wheat protein, particularly in baked products.

The key players in this market include ADM (US), Cargill, Incorporated (US), Tereos (France), Südzucker AG (US), MGP Ingredients (US), Roquette Frères (France), Glico Nutrition Foods Co., Ltd. (Japan), Kerry Group PLC (Ireland), Manildra Group (Australia), and Kröner-Stärke (Germany), among others. The study includes an in-depth competitive analysis of these key players in the wheat protein market with their company profiles, recent developments, and key market strategies.

Key questions addressed by the Wheat Protein Market Report:

- What is the projected market value of the global wheat protein market?

- What is the estimated growth rate (CAGR) of the global wheat protein market for the next five years?

- What are the major revenue pockets in the wheat protein market currently?

- What are the nutritional benefits of wheat protein?

- What are the factors driving the growth of the wheat protein market?

- What are the major players operating in the wheat protein market?