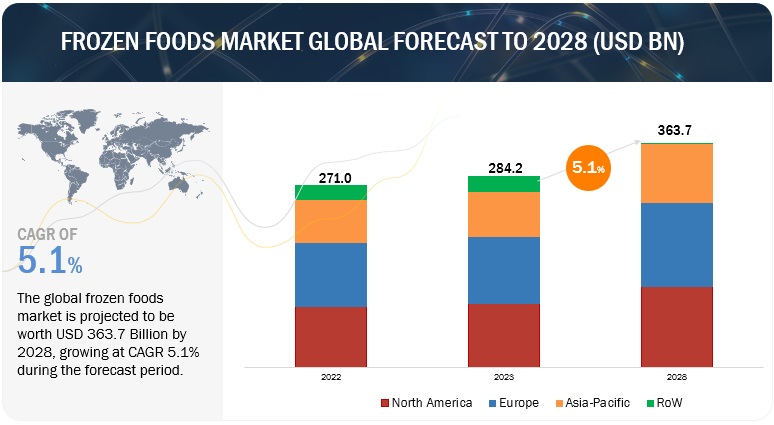

The global frozen foods market, valued at USD 284.2 billion in 2023, is expected to grow at a CAGR of 5.1%, reaching USD 363.7 billion by 2028. Rising consumer demand for convenient meal solutions due to busier lifestyles is driving this growth. Innovations in freezing and packaging technologies have enhanced the quality and shelf life of frozen foods, making them more attractive to consumers. Furthermore, increasing concerns about food waste and a preference for longer-lasting food items are boosting the popularity of frozen products. The growing range of healthier frozen options, including fruits, vegetables, and organic items, aligns with the trend towards health and wellness, fueling further expansion in the market.

Frozen Foods Market Drivers: Rapid Growth in Packaged Food & Beverage Drives Growth in the Frozen Foods Market

The rapid expansion of the packaged food and beverage industry is significantly driving the growth of the frozen foods market. This dynamic is due to several key factors. First, the rise in demand for packaged foods is linked to shifting consumer lifestyles and preferences. Today’s consumers value convenience, portability, and extended shelf life.

Frozen foods perfectly match these demands, offering convenient, ready-to-eat or easy-to-prepare meal options. They provide a practical solution for individuals and families seeking quick and hassle-free dining alternatives.

Additionally, the strong distribution networks and marketing strategies of the packaged food industry help frozen food products reach a wider audience. This mutual growth benefits both sectors as they address the evolving consumer desire for convenience and variety in their food options.

Frozen Foods Market Opportunities: Rising disposable incomes in emerging economies, driving frozen foods segment

The growth of processed food trade presents a major opportunity for the frozen foods market. As global trade networks expand, the frozen foods industry stands to gain in several ways. First, increased international trade allows for a greater exchange of processed foods, including frozen options, giving consumers access to a broader selection of global products and enhancing their culinary experiences. Second, globalization facilitates the import and export of frozen food ingredients, leading to cost-effective sourcing of raw materials. This can result in more competitive pricing and higher profitability for frozen food manufacturers. Additionally, international trade fosters innovation and the creation of new frozen food products tailored to diverse regional tastes, which can attract a wider consumer base and drive market growth.

- Health and Wellness: Consumers are increasingly seeking healthier frozen food options, including those with organic ingredients, fewer additives, and lower sodium content. There's a growing demand for frozen fruits, vegetables, and lean protein options as people become more health-conscious.

- Plant-Based Alternatives: With the rise in vegetarianism, veganism, and flexitarian diets, there's a surge in demand for plant-based frozen foods. This includes plant-based meat substitutes, dairy-free ice creams, and vegetable-based frozen meals, catering to the needs of diverse dietary preferences.

- Convenience and Time-Saving: Busy lifestyles and hectic schedules have fueled the demand for convenient meal solutions. Frozen foods offer quick and easy meal options without compromising on taste or nutrition. Single-serve frozen meals, microwaveable snacks, and pre-cut frozen produce are gaining popularity among consumers seeking hassle-free meal solutions.

- Premiumization: Consumers are willing to pay more for higher-quality frozen food products. Brands are focusing on premium ingredients, innovative packaging, and gourmet flavors to differentiate themselves in the market. Premium frozen pizzas, artisanal ice creams, and specialty frozen appetizers are witnessing increased demand among discerning consumers.

Europe Dominates the Frozen Foods Market Share.

Europe is a major center for frozen vegetable consumption, fueled by busy lifestyles and a growing demand for convenient, nutritious, and cost-effective food options. Increased incomes and evolving dietary preferences are driving this market, with a notable shift toward plant-based diets. Key opportunities for vegetable suppliers are concentrated in Germany, France, Belgium, Italy, and the Netherlands. The rising awareness of the nutritional benefits of frozen vegetables over fresh and refrigerated options is boosting demand, particularly among younger consumers.

In 2021, Europe imported frozen vegetables worth €3 billion, totaling 2.8 million tonnes. Of these imports, 91% came from within Europe, while only 9% were sourced from developing countries. Europe’s position as a leading global producer of frozen vegetables supports this predominantly internal trade. Germany, with a 20% market share, is the top importer, followed by France (18%) and Belgium (14%). Germany and France, in particular, are key focus markets, while Belgium, although a significant producer and exporter, also imports some vegetable varieties. Italy, the Netherlands, Spain, and Sweden are also important markets in Europe.

Germany ranks as the world’s third-largest importer of frozen vegetables, trailing only the United States and Japan, and leads Europe in this sector. In 2021, 90% of Germany’s frozen vegetable imports came from other European countries, with the remaining 10% sourced from developing nations. This strong intra-European import activity plays a crucial role in the growth of the European frozen foods market.

The contract catering sector, where organizations outsource catering services to specialized companies, is gaining traction across businesses, public authorities, childcare centers, educational institutions, healthcare facilities, and correctional institutions in Europe. According to Food Service Europe, the contract catering industry has an annual turnover exceeding USD 26.59 billion and shows significant growth potential, as only 35% of European firms or collective organizations providing social food services currently have catering contracts.

The key players in this market include General Mills Inc. (US), Nestlé (Switzerland), Unilever (Netherlands), McCain Foods Limited (Canada), Conagra Brands, Inc. (US), Kellogg's Company (US), Grupo Bimbo (Mexico), and The Kraft Heinz Company (US)