The global beer processing market size was valued at approximately USD 760.41 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4% during the forecast period from 2024 to 2032. This growth is driven by increasing demand for craft beer, technological advancements in brewing processes, and the expansion of beer production in emerging markets. This article provides a comprehensive overview of the market, including its outlook, size, dynamics, drivers, challenges, segmentation, recent developments, and insights into key components, end-users, and regional markets. Additionally, it answers six frequently asked questions (FAQs) about the beer processing market.

Market Outlook

The global beer processing market is poised for steady growth over the next decade, driven by changing consumer preferences, innovations in brewing technology, and the rising popularity of craft beers. As consumers become more health-conscious, there is also a growing demand for low-alcohol and non-alcoholic beer options, further expanding the market. Moreover, the increasing purchasing power in emerging economies and the expansion of distribution networks are expected to contribute to the market's growth.

Report Overview

This report delves into the beer processing market, providing detailed insights into various aspects such as market size, dynamics, drivers, challenges, segmentation, and recent developments. It also examines the key components, end-users, and regional markets, offering a holistic view of the market's trajectory from 2024 to 2032.

Market Size

In 2023, the global beer processing market was valued at approximately USD 760.41 billion. With a projected CAGR of 4%, the market is expected to reach around USD 1,046.26 billion by 2032. This growth is fueled by the increasing consumption of beer across the globe, the rise of microbreweries, and the continuous innovation in beer flavors and types.

Market Dynamics

Market Drivers

Rising Demand for Craft Beer: The global craft beer market has witnessed significant growth in recent years, driven by consumers' preference for unique flavors and premium products. This trend is expected to continue, driving the overall beer processing market.

Technological Advancements: Innovations in brewing technology, such as automation and digitalization, have enhanced the efficiency and quality of beer production. These advancements are making beer processing more cost-effective and scalable, contributing to market growth.

Expanding Beer Production in Emerging Markets: Emerging economies, particularly in Asia-Pacific and Latin America, are seeing increased beer consumption due to rising incomes and changing social habits. This is driving the expansion of beer production facilities in these regions, boosting the market.

Health and Wellness Trends: The growing trend of health consciousness among consumers is leading to increased demand for low-alcohol and non-alcoholic beers. These products are gaining popularity, especially in developed markets, contributing to the overall growth of the beer processing market.

Key Market Challenges

Stringent Regulations: The beer industry is subject to various regulations concerning production, distribution, and marketing. Compliance with these regulations can be challenging, especially in different regions with varying standards.

Rising Costs of Raw Materials: The costs of key raw materials such as barley, hops, and water have been rising, impacting the profitability of beer manufacturers. Additionally, fluctuations in energy costs can affect production expenses.

Environmental Concerns: The beer industry faces increasing pressure to reduce its environmental impact, particularly in water usage and carbon emissions. Companies are investing in sustainable practices, which can increase operational costs.

Changing Consumer Preferences: While craft beers are currently in demand, consumer preferences can shift rapidly. The challenge for breweries is to stay ahead of trends and continuously innovate to meet evolving tastes.

Segmentation

The global beer processing market can be segmented based on type, equipment, distribution channel, and region.

By Type

Lager: Lager is the most consumed type of beer globally, known for its crisp and refreshing taste. It accounts for the largest market share and is expected to continue dominating the market.

Ale: Ale is a popular type of beer, especially in Europe and North America. It includes subtypes like pale ale, India pale ale (IPA), and stout, each with distinct flavors.

Craft Beer: Craft beer has been gaining popularity for its unique flavors and artisanal production methods. The craft beer segment is expected to grow rapidly during the forecast period.

Non-Alcoholic Beer: With the growing health consciousness among consumers, the demand for non-alcoholic beer is on the rise. This segment is expected to witness significant growth.

By Equipment

Milling Equipment: Milling is the first step in the beer production process, where malted barley is crushed to extract fermentable sugars.

Mashing Equipment: Mashing equipment is used to mix milled grains with water to create a mash, which is then heated to convert starches into fermentable sugars.

Fermentation Equipment: This equipment is used to ferment the mash, where yeast converts sugars into alcohol and carbon dioxide.

Filtration Equipment: Filtration equipment is used to remove solids and impurities from the beer, ensuring clarity and stability.

Packaging Equipment: This includes equipment for bottling, canning, and kegging beer, which is essential for distribution.

By Distribution Channel

On-Trade: This includes bars, restaurants, and pubs where beer is consumed on the premises. The on-trade segment accounts for a significant share of the market.

Off-Trade: This includes retail outlets such as supermarkets, liquor stores, and online platforms where beer is purchased for home consumption.

Recent Developments

Sustainable Brewing Practices: Many breweries are adopting sustainable practices, such as using renewable energy, recycling water, and reducing waste. These initiatives are driven by both regulatory pressures and consumer demand for eco-friendly products.

Innovation in Flavors: Breweries are continuously innovating with new flavors and beer types to cater to diverse consumer preferences. This includes experimenting with exotic ingredients, barrel aging, and hybrid styles.

Expansion of Microbreweries: The number of microbreweries has been increasing globally, particularly in North America and Europe. These small-scale breweries are driving the craft beer segment and contributing to market growth.

Investments in Technology: Major players in the beer processing market are investing in advanced technologies, such as automation and artificial intelligence, to improve production efficiency and product quality.

Component Insights

Raw Materials

The primary raw materials used in beer processing include barley, hops, water, and yeast. The quality of these materials directly impacts the flavor, aroma, and overall quality of the beer.

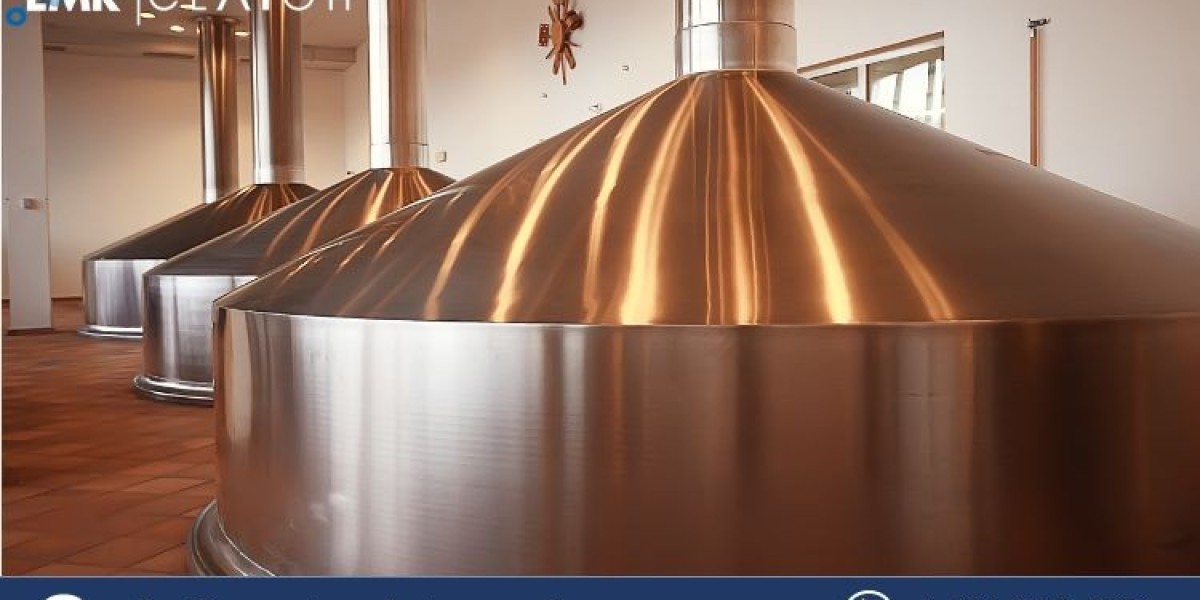

Processing Equipment

Advanced processing equipment is crucial for efficient beer production. This includes milling, mashing, fermentation, filtration, and packaging equipment. Innovations in this area are helping breweries increase productivity and reduce costs.

Packaging

Packaging plays a critical role in the beer industry, not only in preserving the quality of the product but also in branding and marketing. Breweries are increasingly adopting sustainable packaging solutions, such as recyclable cans and bottles, to appeal to eco-conscious consumers.

End-user Insights

Consumers

Individual consumers are the primary end-users of beer, purchasing it for personal consumption. The demand for beer varies by region, influenced by cultural preferences, economic conditions, and social trends.

Commercial Establishments

Bars, restaurants, and pubs are significant end-users of beer, particularly for on-trade consumption. These establishments are key drivers of beer sales, especially for premium and craft beer segments.

Retailers

Retailers, including supermarkets, liquor stores, and online platforms, are essential distribution channels for beer. They cater to the off-trade segment, providing consumers with convenient access to a wide range of beer products.

Regional Insights

North America

North America is a significant market for beer processing, driven by the popularity of craft beer and the presence of major breweries. The United States is the largest market in the region, with Canada also contributing to market growth.

Europe

Europe is another major market, with a long history of beer production and consumption. Countries like Germany, the UK, and Belgium are known for their beer culture and diverse beer offerings. The region is also witnessing growth in the craft beer segment.

Asia-Pacific

Asia-Pacific is an emerging market for beer processing, with increasing consumption in countries like China, India, and Japan. The region's growing middle class and expanding urban population are driving demand for beer.

Latin America

Latin America is experiencing growth in the beer processing market, particularly in Brazil, Mexico, and Argentina. The region's favorable climate for barley cultivation and the increasing popularity of craft beer are contributing to market expansion.

Middle East and Africa

The Middle East and Africa are emerging markets for beer processing, with growing demand for both alcoholic and non-alcoholic beer. The region's young population and changing social dynamics are driving market growth.

Key Players

Anheuser-Busch InBev NV: The world's largest brewer, known for brands like Budweiser, Corona, and Stella Artois. AB InBev has a significant presence in North America, Europe, and Asia-Pacific.

Heineken N.V.: A leading global brewer with a diverse portfolio of beer brands, including Heineken, Amstel, and Tiger. Heineken is expanding its presence in emerging markets.

Carlsberg A/S: A major brewer based in Denmark, Carlsberg is known for its premium beer brands and strong presence in Europe and Asia.

Molson Coors Brewing Company: A North American brewing giant, Molson Coors owns popular brands like Coors Light, Miller Lite, and Blue Moon.

Asahi Group Holdings Ltd.: A Japanese brewery with a strong international presence, Asahi is expanding its global footprint through acquisitions and partnerships.

Tsingtao Brewery Group Co. Ltd.: One of China's largest brewers, Tsingtao is known for its flagship brand Tsingtao Beer and has a growing presence in international markets.

Market Trends

Rising Demand for Craft Beer: The craft beer segment is growing rapidly, driven by consumer demand for unique flavors and artisanal products. This trend is particularly strong in North America and Europe.

Sustainable Brewing: Sustainability is a key trend in the beer processing market, with breweries adopting eco-friendly practices to reduce their environmental impact.

Health and Wellness: The demand for low-alcohol and non-alcoholic beers is increasing as consumers become more health-conscious. Breweries are responding with new product offerings that cater to this trend.

Premiumization: Consumers are willing to pay more for premium and high-quality beers, driving growth in the premium beer segment. This trend is particularly evident in mature markets like Europe and North America.

Industry News

AB InBev Expands Craft Beer Portfolio: Anheuser-Busch InBev is expanding its craft beer portfolio with acquisitions and new product launches to cater to the growing demand for craft beers.

Heineken Launches Sustainability Initiatives: Heineken has launched several sustainability initiatives, including reducing water usage and increasing the use of renewable energy in its breweries.

Carlsberg Invests in Digitalization: Carlsberg is investing in digital technologies to improve production efficiency and enhance consumer engagement through digital marketing.

Asahi Acquires Craft Breweries: Asahi Group is expanding its craft beer portfolio through strategic acquisitions, aiming to capture a larger share of the global craft beer market.

Application Insights

Brewing

Brewing is the core application of beer processing, involving the conversion of raw materials like barley and hops into beer. Technological advancements in brewing are improving efficiency and product quality.

Packaging

Packaging is a critical application in the beer processing industry, ensuring the preservation and presentation of beer. Breweries are increasingly adopting sustainable packaging solutions to meet consumer demand.

Distribution

Distribution involves the logistics of getting beer from breweries to consumers. Efficient distribution networks are essential for meeting consumer demand and expanding market reach.

FAQs

What is the expected growth rate of the global beer processing market?

- The global beer processing market is expected to grow at a CAGR of 4% between 2024 and 2032.