Industrial Hemp Market Poised for Remarkable Growth

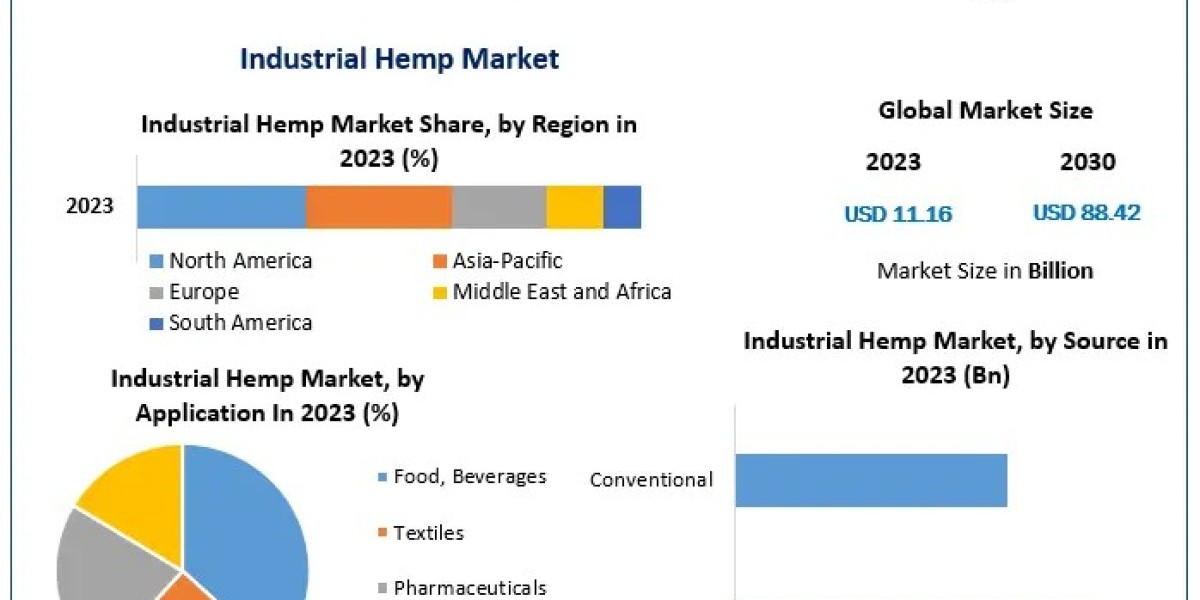

The global industrial hemp market is experiencing unprecedented expansion, with its valuation soaring from USD 11.16 billion in 2023 to a projected USD 88.42 billion by 2030. This impressive growth corresponds to a Compound Annual Growth Rate (CAGR) of 34.4% during the forecast period of 2024 to 2030.

Key Drivers of Market Expansion

Several factors are propelling the industrial hemp market's rapid growth:

Legalization and Regulatory Support: The global shift towards legalizing industrial hemp cultivation has opened new avenues for market players. Notably, the 2018 U.S. Farm Bill reclassified hemp, distinguishing it from marijuana, and legalized its cultivation, leading to a surge in production and innovation.

Diverse Industrial Applications: Hemp's versatility spans multiple industries, including textiles, food and beverages, personal care products, and pharmaceuticals. Its fibers are integral to sustainable textiles, while hemp seeds and oils are gaining popularity in health foods and supplements.

Health and Wellness Trends: The rising consumer awareness of the health benefits associated with hemp-derived products, particularly cannabidiol (CBD), has significantly boosted demand in the wellness sector.

Intrigued to explore the contents? Secure your hands-on sample copy of the report:https://www.maximizemarketresearch.com/request-sample/33440/

Regional Insights

The industrial hemp market's growth trajectory varies across regions:

Asia-Pacific: This region is expected to register the highest CAGR during the forecast period. Countries like China and India are capitalizing on vast farmlands and low production costs, positioning themselves as major producers and exporters of industrial hemp. Supportive regulations in Australia, India, and Thailand further bolster market expansion.

North America: The U.S. and Canada are witnessing robust market growth, driven by high consumer disposable income and increasing awareness of hemp's health benefits. The U.S., in particular, has seen a significant boost following the legalization of hemp cultivation, leading to increased production and demand across various industries.

Europe: With significant contributions from countries like France, Germany, and the Netherlands, Europe holds a substantial share of the global industrial hemp market. France stands out as the largest hemp producer in the region, accounting for over 69.7% of Europe's production. The market benefits from strong regulatory support for sustainable and eco-friendly products, driving demand in textiles, construction materials, and personal care products.

Competitive Landscape

The industrial hemp market is characterized by a dynamic competitive landscape:

Key Players: Prominent companies such as Manitoba Harvest, Hemp, Inc., Canopy Growth Corporation, Charlotte's Web Holdings, Inc., and CV Sciences, Inc. are leading the charge, focusing on product innovation and expanding their market presence.

Strategic Initiatives: Companies are engaging in mergers, acquisitions, and partnerships to strengthen their foothold. For instance, in October 2024, Canopy Growth Corporation acquired Wana, enhancing its product portfolio and market reach.

Excited to dive in? Request your sample copy of the report to uncover its contents:https://www.maximizemarketresearch.com/request-sample/33440/

Country-Specific Developments

- United States: Industrial Hemp Consolidation in the United States

The U.S. industrial hemp market is experiencing consolidation, with major players engaging in mergers and acquisitions to enhance market share. In October 2024, Canopy Growth Corporation acquired Wana, aiming to build a leading brand-focused cannabis company in the U.S.

China: Industrial Hemp Growth in China

China remains the world's leading producer of industrial hemp, contributing more than 70% of global output. The country's well-established textile industry heavily incorporates hemp fibers, and there's a burgeoning interest in hemp-derived CBD products for both domestic consumption and export.

Europe: Industrial Hemp Updation in Europe

Europe is updating its regulatory frameworks to accommodate the growing industrial hemp market. France leads in production, while countries like Germany and the Netherlands are expanding cultivation areas. The European Union is also funding research projects to explore hemp's applications in sustainable construction and biodegradable plastics.

Market Segmentation: In-Depth Analysis:

by Type

Hemp Seed

Hemp Seed Oil

CBD Hemp Oil

Hemp Fiber

Hemp seed, hemp seed oil, CBD hemp oil, and hemp fiber are the different market segments. Over the course of the forecast period, the hemp fiber segment is anticipated to dominate the market. The fibers of hemp are classified as hurds (inner short fibers) and bast (outer long strands). The bast fibers are further classified into two groups: primary bast fibers, which can reach a length of 50 mm and contain 50–70% cellulose, and secondary bast fibers, which are only around 2 mm long. Because bast fibers can be spun and knitted, they are mostly used in the textile industry. The short fibers, known as hurds, are about 0.5 mm long and comprise 70–80% of the hemp stalk.

by Application

Food, Beverages

Personal Care Products

Textiles

Pharmaceuticals

Others

Food, drinks, textiles, personal care items, medications, and other categories make up the market's segments. Forecasts indicate that the food segment will dominate the industrial hemp market. This is because hemp is used to make foods that are high in minerals including protein, calcium, zinc, iron, salt, potassium, and magnesium, as well as linoleic and linolenic acid and vitamin E. The most popular way to consume hemp seeds is raw or roasted. It is found in cereals, yogurt, smoothies, and salads. As veganism gains popularity worldwide, it is predicted that the demand for processed foods made from hemp, such as bars, flour, snacks, and cheese, will increase in response to the growing consumption of plant-based protein.

by Source

Organic

Conventional

The market is divided into two segments: conventional and organic. Conventional hemp products dominated the industrial market since they are less costly than organic hemp products. Additionally, even though commercial hemp is not certified, it is rich in vitamins and other essential fatty acids.

Industry Leaders: Key Players in Focus:

1. Valley Bio Ltd.

2. Hemp, Inc.

3. Terra Tech Corp.

4. American Hemp

5. Ecofiber Industries Operations

6. Botanical Genetics, LLC

7. Marijuana Company of America, Inc.

8. HempMedsBrasil

9. CBD Biotechnology Co.

10.Plains Industrial Hemp Processing Ltd.

11.HempFlax B.V.

12.Industrial Hemp Manufacturing, LLC

13.Boring Hemp Company

14.American Cannabis Company, Inc.

15.Parkland Industrial Hemp Growers Cooperative Ltd.

Explore the hottest research findings from Maximize Market Research that are making waves:

Global Industrial Sheaves and Pulleys Market https://www.maximizemarketresearch.com/market-report/global-industrial-sheaves-and-pulleys-market/92565/

Global Biofuel Testing Services Market https://www.maximizemarketresearch.com/market-report/global-biofuel-testing-services-market/119625/

About Maximize Market Research:

Maximize Market Research is dedicated to providing insightful market analysis across diverse industries—from technology to pharmaceuticals. Our expert team delivers validated estimations, strategic advice, and actionable insights to empower your business decisions.

Connect with Us:

For personalized insights and expert consultation, reach out to us:

Maximize Market Research

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

+91 9607365656