Global Medical Polymer Market Overview, Trends, and Forecast (2024-2032)

Global Medical Polymer Market Expected to Reach USD 77.23 Billion by 2032, Driven by Rising Demand for Minimally Invasive Surgeries and Technological Advancements

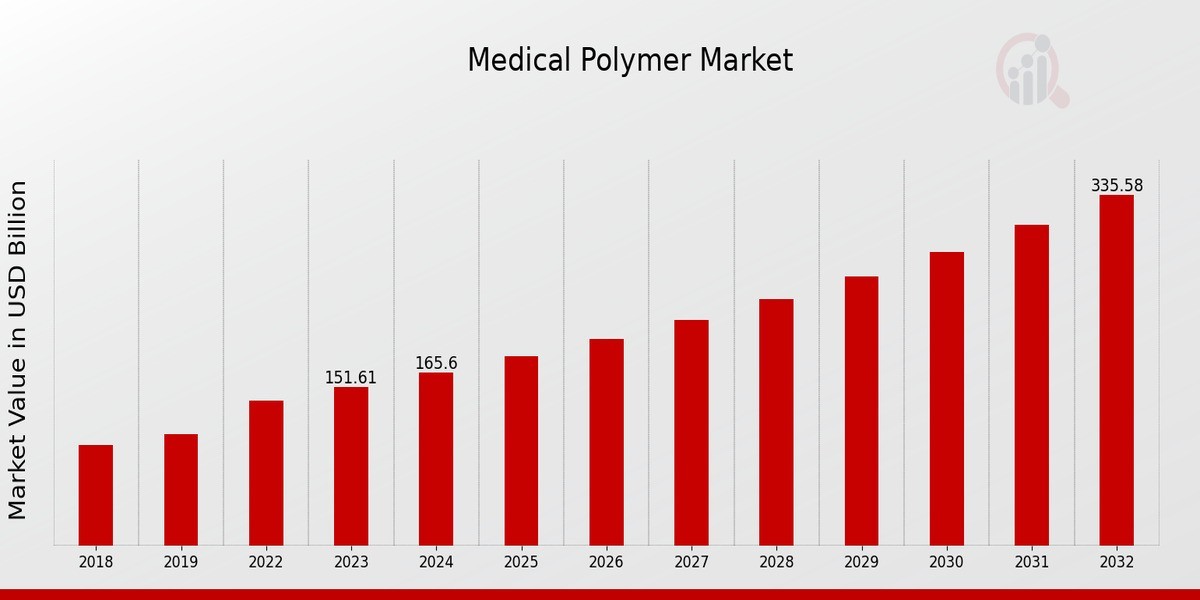

The global medical polymer market is on a strong growth trajectory, with an estimated market size of USD 38.93 billion in 2023. According to MRFR’s latest analysis, the market is expected to grow from USD 41.84 billion in 2024 to USD 77.23 billion by 2032, exhibiting a robust compound annual growth rate (CAGR) of 7.96% during the forecast period.

Market Overview

Medical polymers play a crucial role in the healthcare industry, offering diverse applications in medical devices, drug delivery systems, tissue engineering, and medical packaging. With the increasing prevalence of chronic diseases, rising demand for minimally invasive procedures, and continuous advancements in polymer technology, the global market for medical polymers is experiencing significant growth.

Key drivers of the market include the aging population, technological advancements in medical devices, and the growing adoption of biodegradable and biocompatible polymers. Moreover, the market is being shaped by a growing trend toward sustainable and environmentally friendly materials.

Market Scope and Segmentation

The global medical polymer market is segmented based on product type, application, polymer type, and end-use, providing a detailed analysis of the industry’s diverse aspects.

Product Type:

- Biodegradable Polymers

- Non-biodegradable Polymers

Application:

- Medical Devices

- Drug Delivery

- Tissue Engineering

- Medical Packaging

Polymer Type:

- Polypropylene

- Polyethylene

- Polyurethane

- Polystyrene

- Polyvinylchloride

End-Use:

- Hospitals

- Clinics

- Diagnostic Centers

Regional Analysis

North America currently leads the global market, accounting for over 35% of the market share in 2023. The region's dominance is attributed to its well-established healthcare infrastructure, high adoption of advanced medical technologies, and a large patient population. The market in Europe is expected to grow steadily, driven by increasing healthcare expenditures and government initiatives to improve healthcare access.

The Asia-Pacific region is anticipated to experience significant growth during the forecast period due to rising healthcare spending, growing populations, and increasing prevalence of chronic diseases. Meanwhile, the South America and Middle East & Africa markets are expected to grow at a moderate pace, fueled by improving healthcare infrastructure and demand for medical devices.

Key Market Drivers

Minimally Invasive Procedures: The increasing demand for minimally invasive surgeries, such as laparoscopic and endoscopy procedures, is driving the market. Medical polymers are used in devices such as catheters, implants, and surgical instruments for these procedures.

Aging Population and Chronic Diseases: The rising prevalence of chronic diseases, especially among the aging population, is boosting the demand for polymer-based medical tools, devices, and implants.

Technological Advancements: Continuous advancements in polymer science are enabling the development of innovative materials with improved properties like biocompatibility, durability, and enhanced functionality, thus supporting the growth of the market.

Key Players and Competitive Landscape

The medical polymer market is highly competitive with several key players striving to expand their market presence and diversify their product offerings. Key players include:

- Covestro AG

- SABIC

- DowDuPont

- Evonik Industries

- BASF SE

- Celanese Corporation

- Mitsubishi Engineering Plastics Corporation

- Solvay

- Teijin Limited

These companies are investing heavily in research and development to introduce innovative medical polymers and strengthen their product portfolios. Strategic partnerships, collaborations, and mergers and acquisitions are common strategies among market players to expand their geographical reach.

Recent Developments

October 2024: BASF announced a significant increase in investment to expand its medical plastics production facilities in North America, enhancing its ability to supply biocompatible materials for medical devices such as injectors and catheters.

April 2024: Dow launched a new range of thermoplastic elastomers (TPEs) specifically designed for the medical sector, including medical tubing and infusion pumps.

January 2024: DSM unveiled a variety of polyurethanes that offer high biocompatibility for wound and implant devices, with a focus on sterilization tolerance.

October 2023: LG Chem introduced a new elastomeric material for medical devices like catheters and medical bags, offering flexibility and chemical resistance.

Conclusion

The medical polymer market is poised for substantial growth due to the increasing demand for medical devices, the rising incidence of chronic diseases, and technological advancements in polymer science. With the global market forecasted to reach USD 77.23 billion by 2032, the industry is set to benefit from both ongoing innovation and the increasing need for biocompatible, durable materials in healthcare applications.

For more information or to request a free sample, please visit [Medical Polymer Market ].